Don’t miss our upcoming event City Manager to Deliver State of the City Address

Read our latest report Appreciating the Value of Commercial Properties

View our presentation Building for our Future: Modernizing Worcester’s Schools for Future Ready Learning

View our latest Visualization Spring 2024 Broadband Update

Check out our

Recent Reports & Forums

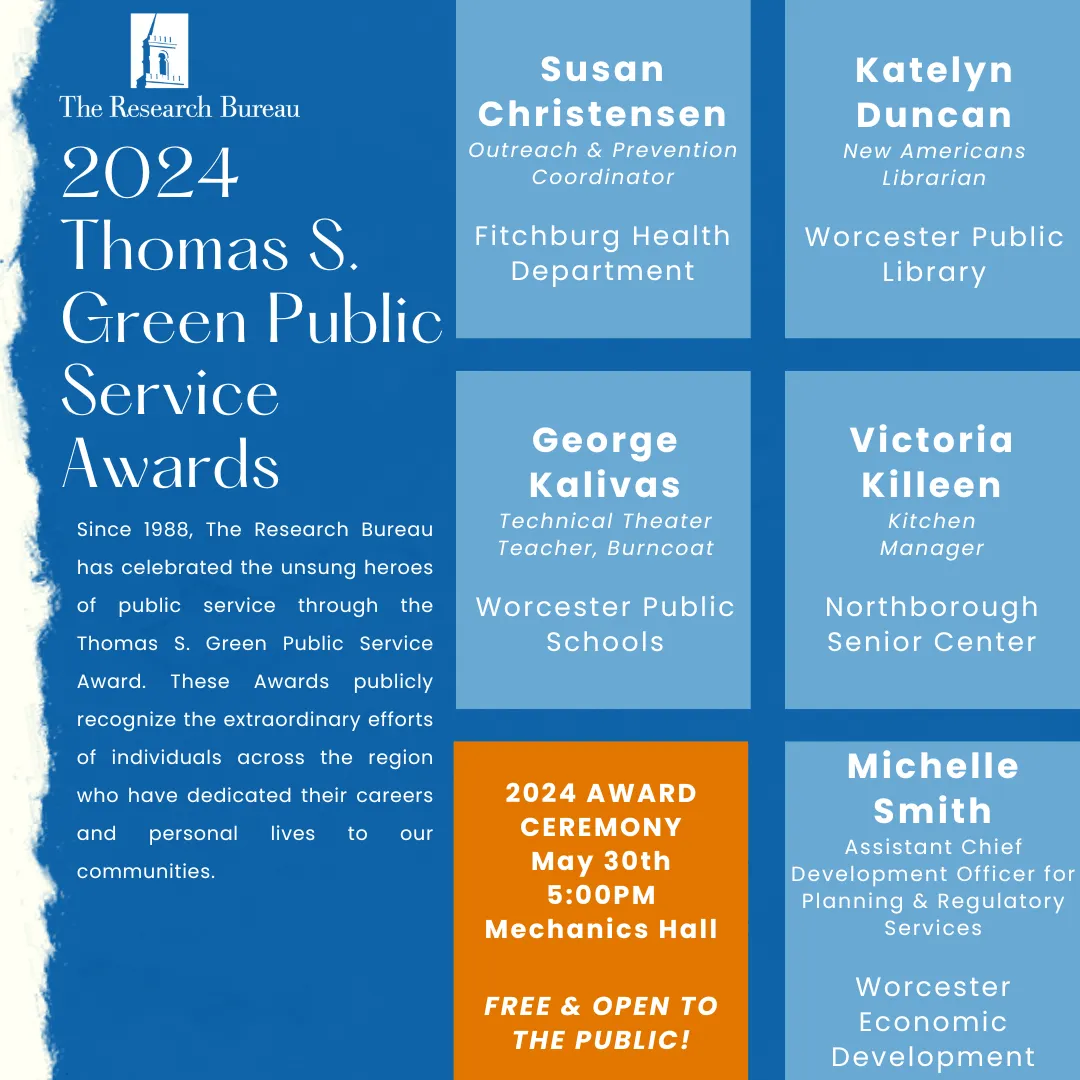

2024 Thomas Green Award Recipients Announced

Worcester Regional Research Bureau announces recipients of the 2024 Thomas S. Green Public Service Awards.Appreciating the Value of Commercial Properties

Commercial Real Estate (CRE) is a key economic engine for municipalities. It provides space for jobs for the community, provides …

Our Specific

Research Areas

Welcome to The Research Bureau

Promoting Informed Debate and Decision-Making through Public Policy Research

The Worcester Regional Research Bureau serves the public interest of Greater Worcester by conducting independent, non-partisan research and analysis of public policy issues to promote informed public debate and decision-making. For thirty years, The Research Bureau has worked to protect the public interest in Greater Worcester by identifying issues, investigating impacts, and educating the public and government officials of opportunities and best practices.

We Invite You To

Suggest a Research Topic

The Research Bureau receives many suggestions for report subjects. When considering the viability of a potential report, WRRB staff asks a series of questions. In an effort to ensure we have answers to these questions when discussing an idea or pitch, we ask that our friends and partners with ideas provide as much detail as possible when submitting.

Stay Up-to-Date

Our Latest News

See Worcester Job, Income, Population Changes over 30 Yrs.

WORCESTER – The Worcester City Council Economic Development Committee will take up a report the Worcester Regional Research Bureau (WRRB) published in September 2023. The WRRB submitted the report to...

Read MoreGuest column: Remove legislative roadblocks to upgrade Worcester schools

Schools without cafeterias. Without auditoriums. Without playgrounds.

Read MoreWRTA Board Approved Fare-Free Transit through June 2025

WORCESTER – The Worcester Regional Transit Authority (WRTA) Advisory Board voted unanimously on Thursday morning to continue its fare free program through June 2025. The board voted to approve the...

Read More

Stay Connected

We Are Here To Keep You Informed

Stay Connected

We Are Here to Keep You Informed