Are you interested in a particular research topic or have an idea for a report?

We invite and welcome you to submit your idea to us. Let us know what you have in mind here.

| Image | Title | Summary | Date Posted | tags_hfilter | |

|---|---|---|---|---|---|

| Appreciating the Value of Commercial Properties | Commercial Real Estate (CRE) is a key economic engine for municipalities. It provides space for jobs for the community, provides own economic value through its use and outputs, and serves as an important source of revenue for City governments. | April 2, 2024 | economic-development | ||

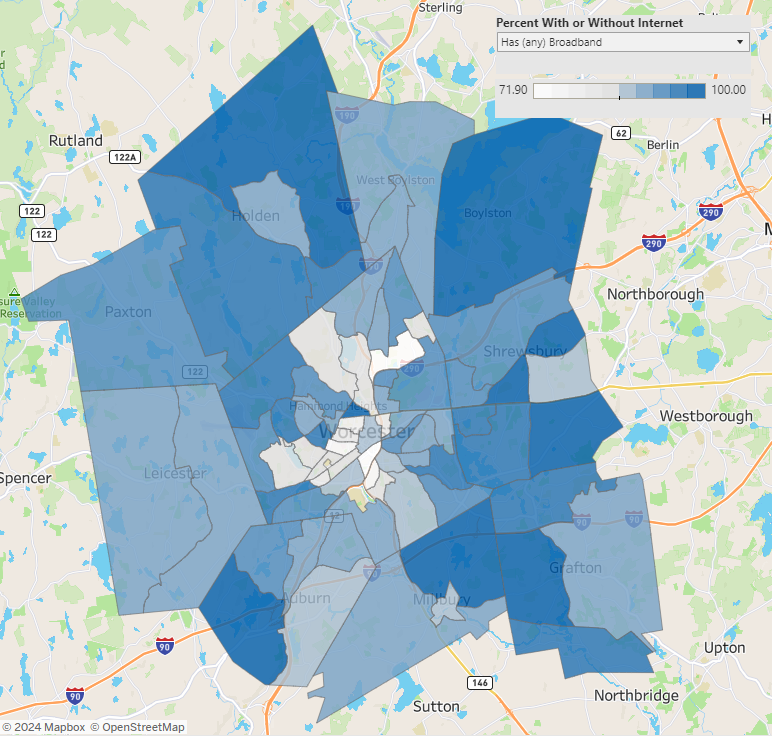

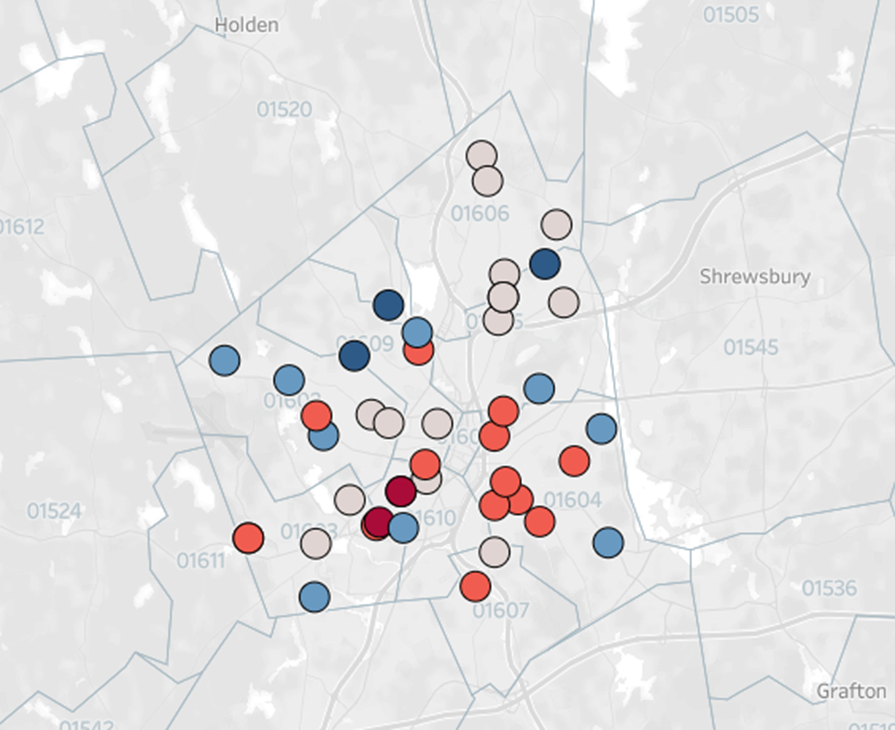

| Spring 2024 Broadband Update | The WRRB’s Broadband Explorer is an interactive tool to show broadband status and other selected data on a Census Tract by Census Tract basis (or Zip Code if only available) for households in Auburn, Boylston, Grafton, Holden, Leicester, Millbury, Paxton, Shrewsbury, West Boylston, and Worcester. | March 6, 2024 | economic-development technology visualizations | ||

| Building the Future: Investing in Worcester Public Schools Facilities | This report provides an overview of Worcester’s public school facilities, detailing the MSBA’s involvement in repair and construction projects, the City and District’s initiatives to improve learning environments, and a secondary examination of the District’s 2017 Facilities Master Plan. | February 29, 2024 | education finance | ||

| Questions to Consider about Worcester’s Now | Next Master Plan | Worcester Now | Next officially kicked off in 2022, and aims to be finished and adopted in spring 2024. The draft plan, currently public, is open to public comment until February 25th. | February 20, 2024 | civic-engagement municipal-operations public-administration | ||

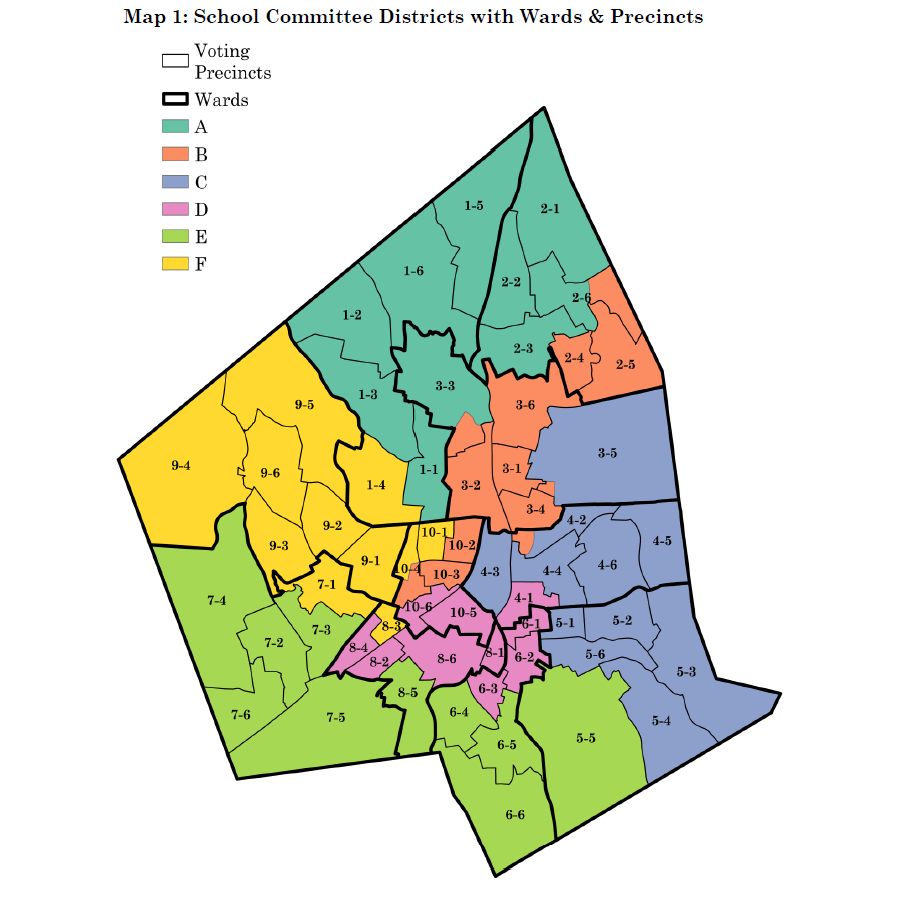

| Understanding Your Neighborhood Schools | Introduction: As of the 2023-24 academic year, Worcester Public Schools (WPS) enrolls an impressive 24,350 scholars across 45 elementary, middle, and high schools collectively. | January 18, 2024 | education | ||

| Energized? No, Specialized: Decoding the New Specialized Stretch Code | ON JULY 1, 2024, both an updated Stretch Code and the Municipal Opt-In Specialized Stretch Code will go into effect in Worcester. While Worcester is already a stretch code community, the City Council voted to adopt the specialized stretch code in September 2023. | December 5, 2023 | environment public-administration | ||

| Worcester Urban Forest Master Plan | IN OCTOBER 2023, the City of Worcester released a draft Urban Forest Master Plan (UFMP), issuing ten recommendations meant to guide the further preservation, management, and expansion of Worcester’s urban forest—and in particular, Worcester’s public “street trees.” | November 29, 2023 | environment public-administration | ||

| Environmental (In)Justice | Understanding the intricate interplay between environmental variables and the communities most affected by them is paramount to fostering equitable urban development. | November 21, 2023 | environment | ||

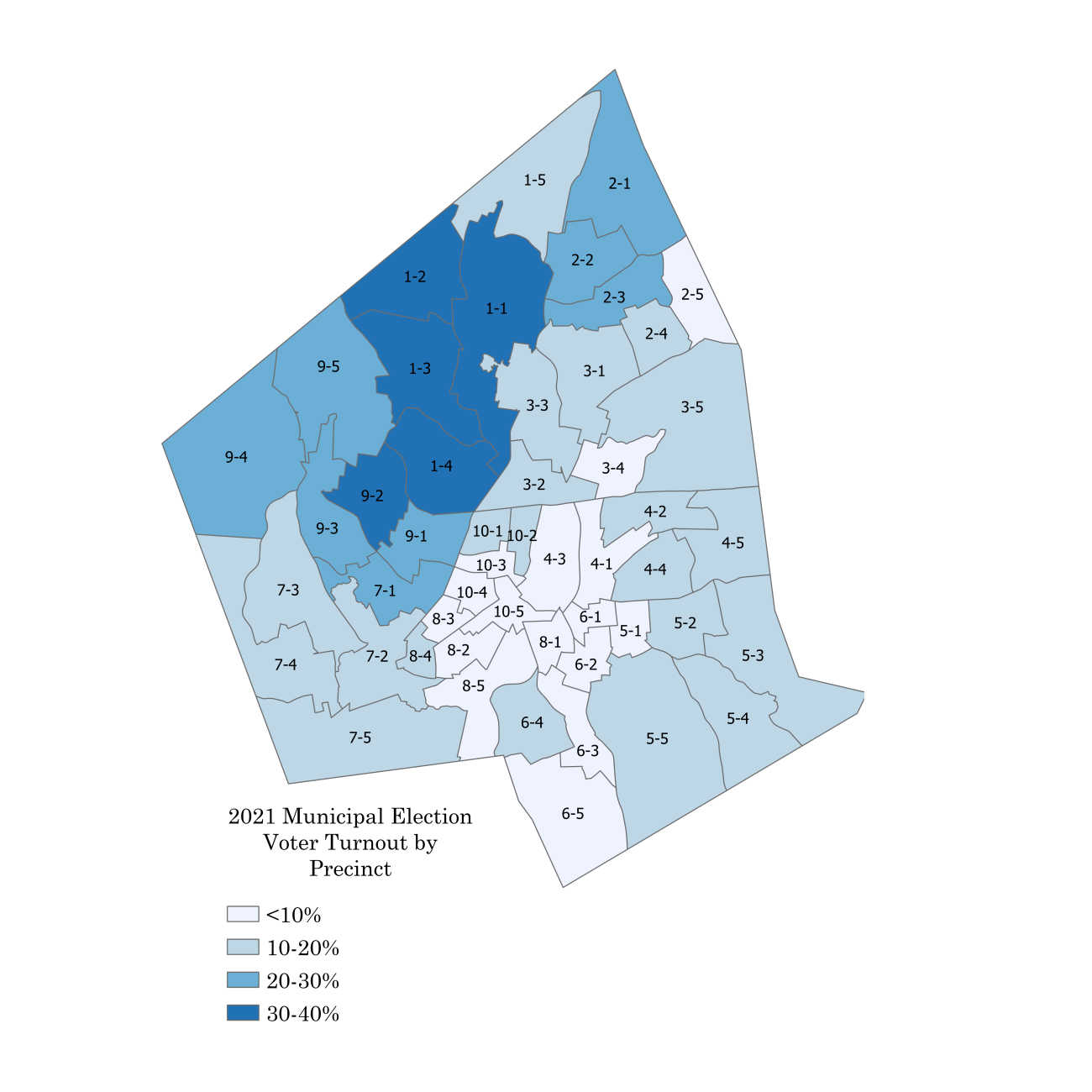

| Worcester’s Municipal Elections, 2013-2023 | This StoryMap presents Worcester’s preliminary and general municipal elections between 2013 and 2023, with a special focus on individual races in 2021 and 2023. | November 15, 2023 | civic-engagement elections visualizations | ||

| Worcester Almanac: 2023 | Worcester Almanac: 2023 compiles data from a variety of sources to inform decision-makers and the general public on important areas of interest for the City of Worcester, surrounding communities, and Worcester County. | October 27, 2023 | worcester-almanac | ||

| Understanding Worcester’s Charter | With Worcester’s 2023 election nearly here, it is worthwhile to release a brief regarding how local government in the City of Worcester is organized in order to create better informed voters. | October 24, 2023 | public-administration | ||

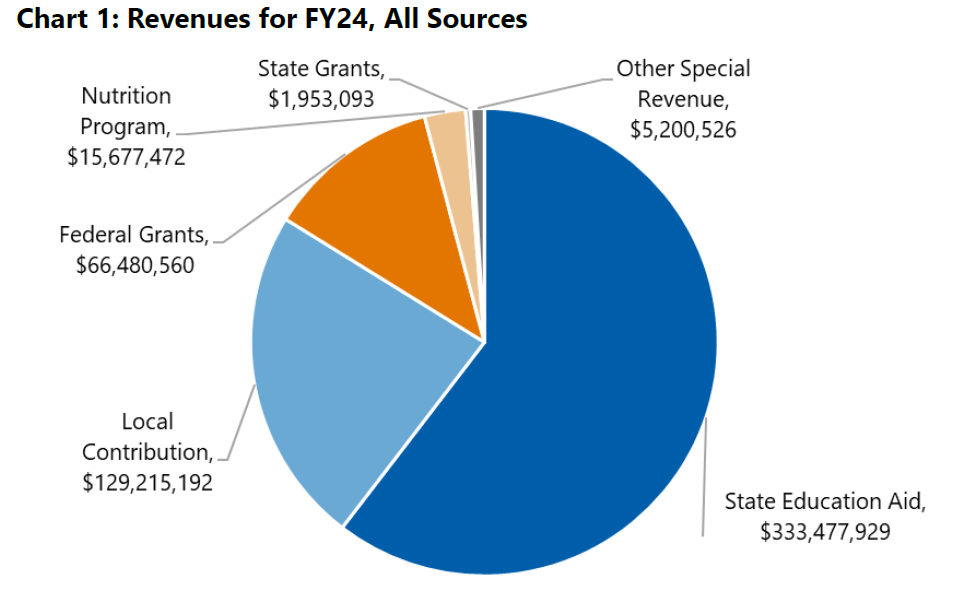

| Paying for a Public Education FY24 | This report, a follow-up to last year’s Investing in Excellence will examine the budget-making process of the Worcester Public Schools, and analyze some of the new additions to this coming year’s adopted budget. | September 25, 2023 | education finance | ||

| Questions for the Candidates | This publication is intended to provide candidates and residents in Worcester with questions for consideration. We offer the following to provoke discussion, debate, and potentially decision as the voters of Worcester select their leaders for the 2024-2025 political cycle. | September 14, 2023 | civic-engagement elections series-questions-for-the-candidates | ||

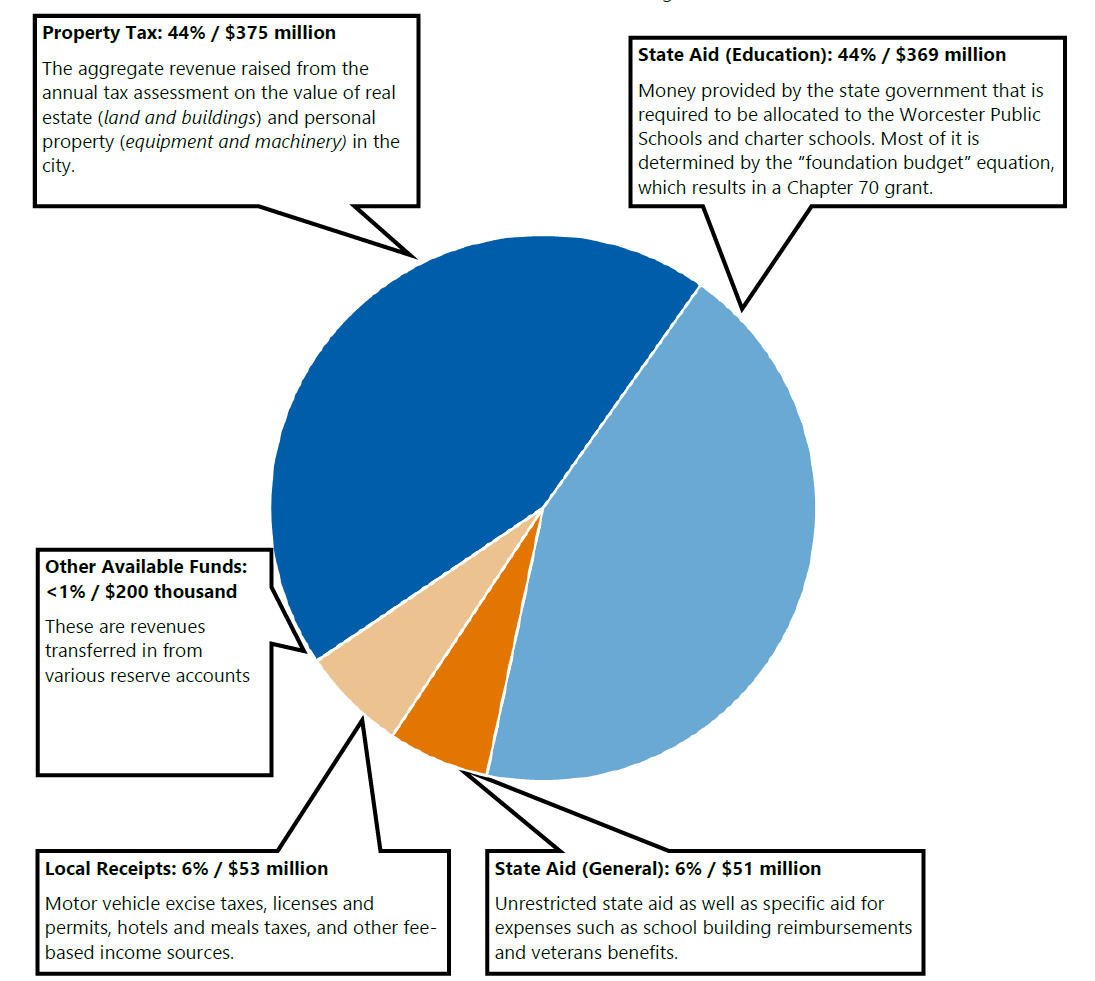

| Breaking Down the Budget FY24 | Each Year on July 1, Massachusetts cities and towns must implement a new budget. The City of Worcester’s Fiscal Year 2024 (FY24) budget, entitled Empower Progress: Investing in Equity, Talent, and Culture, took effect on July 1, 2023. | August 29, 2023 | finance series-breaking-down-the-budget | ||

| Reinventing Worcester | Over the past few decades, the City of Worcester has undergone substantial demographic and economic changes. As an economic and population hub in central Massachusetts, studying past changes helps us to better understand the current regional conditions and to think in a more informed way about the future. | August 16, 2023 | economic-development visualizations | ||

| Bureau Brief—Worcester’s 2023 Election, a Primer | The Worcester Regional Research Bureau is pleased to release Bureau Brief – Worcester’s 2023 Election, a Primer. | May 16, 2023 | civic-engagement elections | ||

| Bureau Brief—Serving on Worcester’s Boards and Commissions | The City of Worcester’s ‘Boards and Commissions’ play a key role in local governance by allowing residents to participate in their community and provide essential ideas and opinions on a number of topics. | May 3, 2023 | civic-engagement public-administration | ||

| Resurging Regional Ridership: An analysis of mobility flows, riders, and ridership in the WRTA region | The WRRB has released a series of reports on the WRTA in recent years, most recently All Aboard: Financing a Fare-Free WRTA. The WRTA’s exceptionally speedy ridership recovery, with 140% of 2019 pre-pandemic values by the end of 2022, may be due in part to the fare-free service begun in March 2020. | April 18, 2023 | transportation | ||

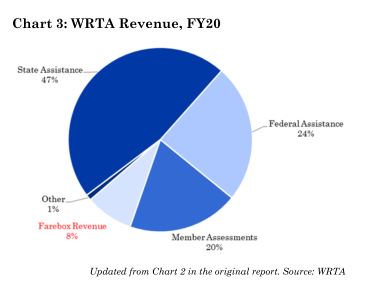

| All Aboard: Financing a Fare-Free WRTA | The Worcester Regional Transit Authority Advisory Board has suspended fares at the agency since March 2020, as a result of the COVID-19 pandemic and subsequent emergency. | March 9, 2023 | finance transportation | ||

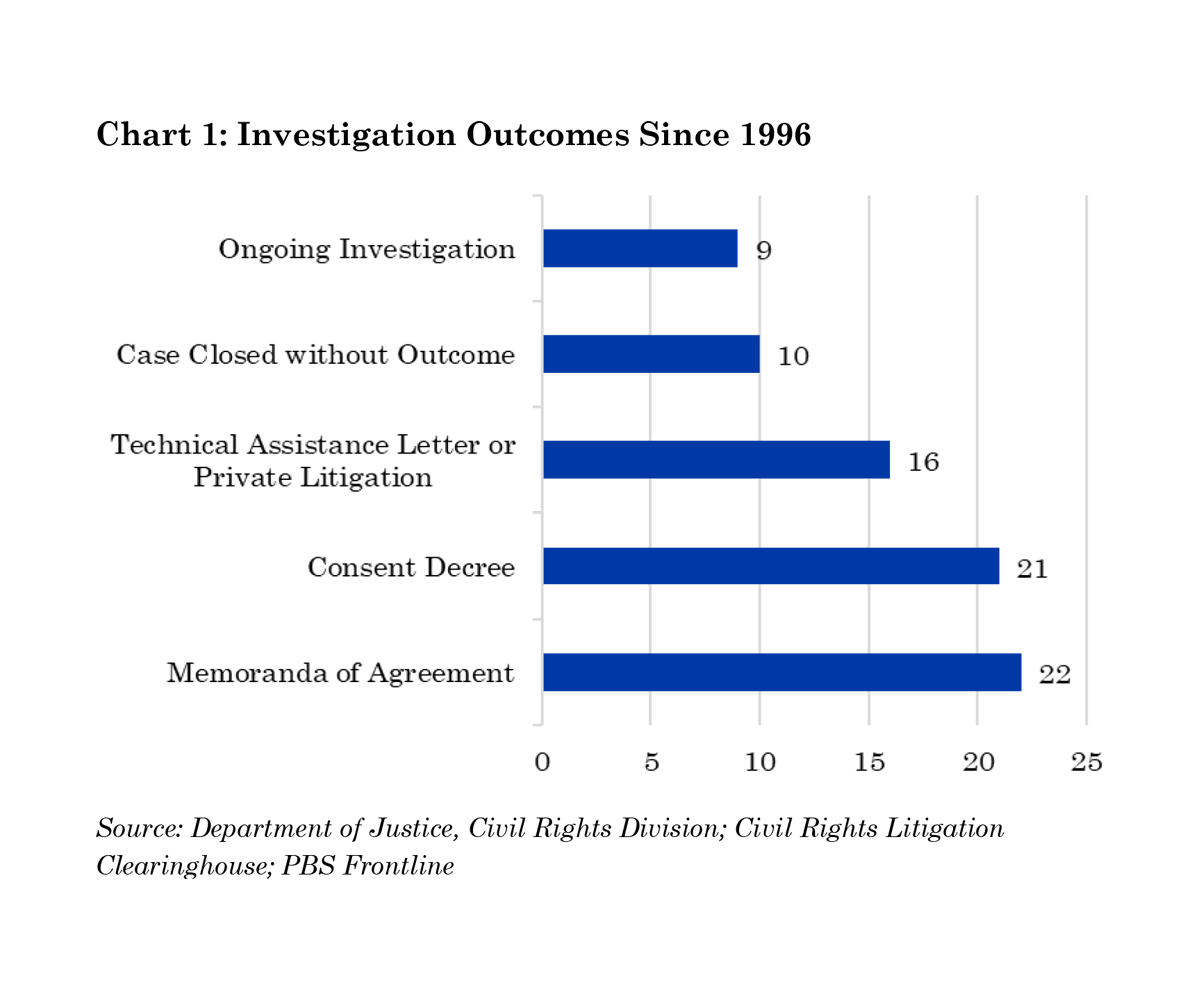

| Bureau Brief: Department of Justice Pattern or Practice Investigations | On November 15, 2022, the Civil Rights Division of the Department of Justice and the Office of U.S. Attorney for Massachusetts Rachel S. Rollins announced the start of a “Pattern-or-Practice” investigation of the Worcester Police Department. | January 26, 2023 | public-safety | ||

| Governing for Excellence: Worcester Public Schools’ Evolution in Governance | The Worcester Public Schools (WPS) is undergoing an evolution in governance, most notably with the shift to district based representation on the School Committee. | December 15, 2022 | education the-excellence-series visualizations | ||

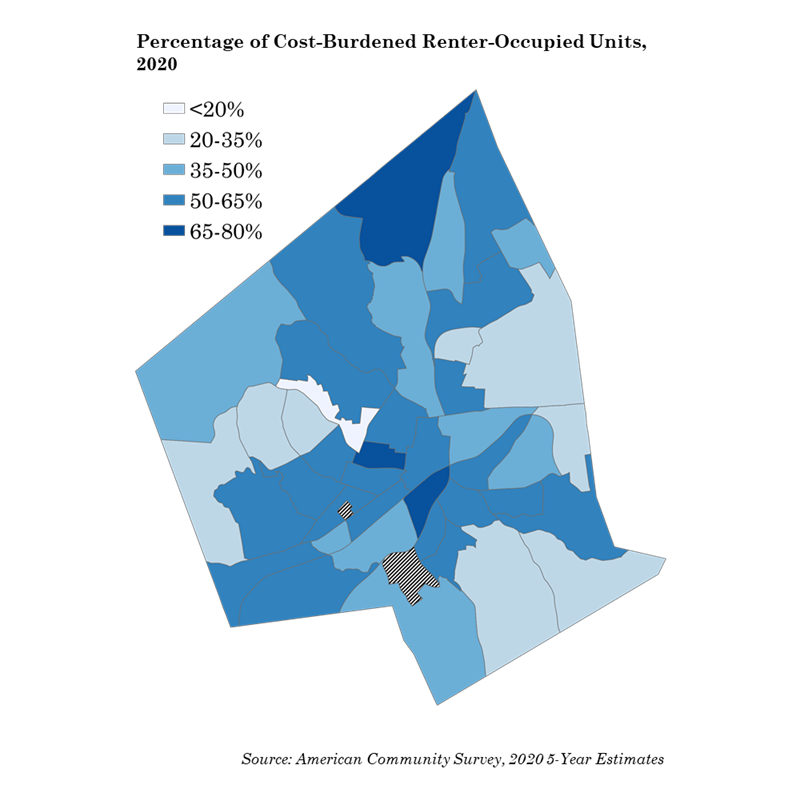

| Static Income, Rising Costs: Renting in the Heart of the Commonwealth | Renter-households in Worcester have become increasingly cost-burdened since 2010; their costs have increased while their wages have remained static in terms of inflation-adjusted dollars. | December 9, 2022 | housing | ||

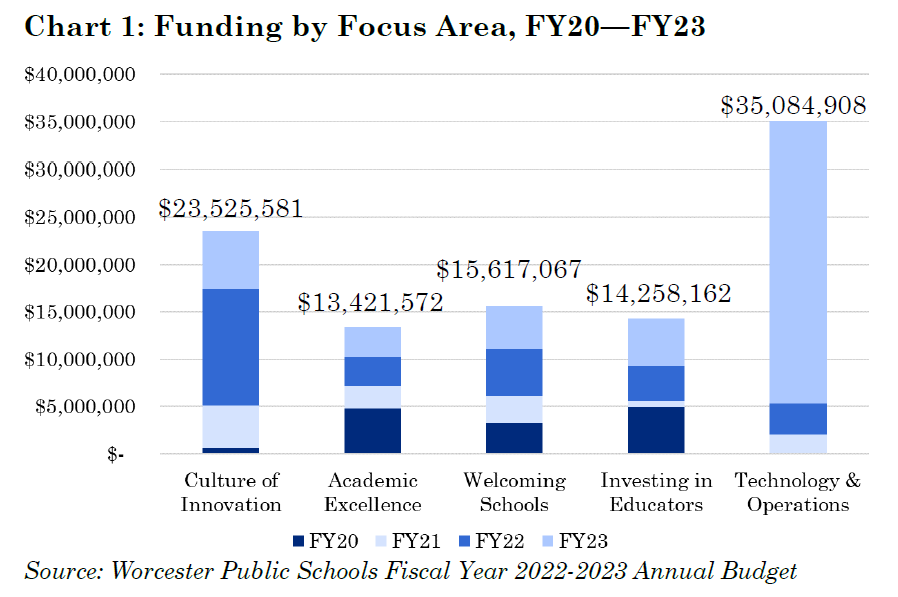

| Strategizing for Excellence: Status of the Worcester Public Schools Strategic Plan | Introduction: As the end of the Strategic Plan approaches, there is a new Superintendent, transitions for the School Committee, and new circumstances presented by the pandemic, WPS must develop its next iteration, learning lessons from Defining our Path. | December 8, 2022 | education the-excellence-series | ||

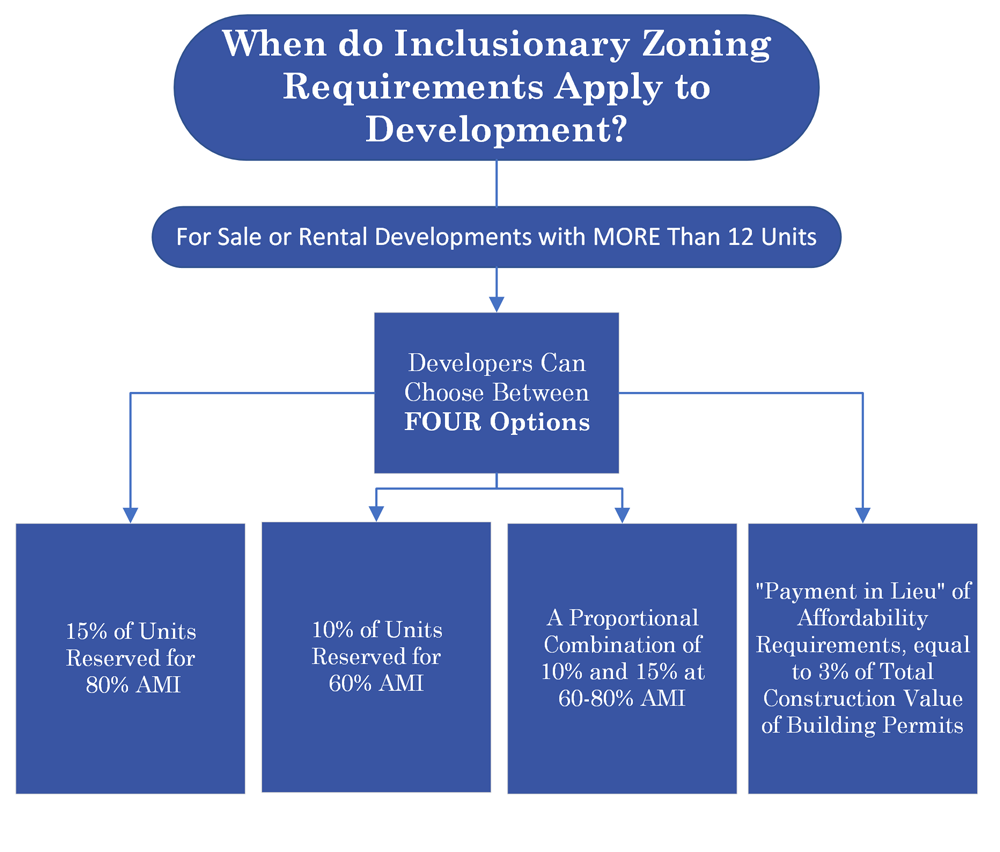

| Inclusionary Zoning | The City Manager’s office put forth a proposal to adopt an “inclusionary zoning” (IZ) policy to amend the Worcester Zoning Ordinance, for new housing built in the city. | November 7, 2022 | economic-development housing | ||

| Is Worcester County Food Insecure? It Depends on Where. | According to the USDA, in 2021, 33.8 million people (including 5 million children) in the United States lived in households that experienced hardships providing enough food. | November 14, 2022 | health visualizations | ||

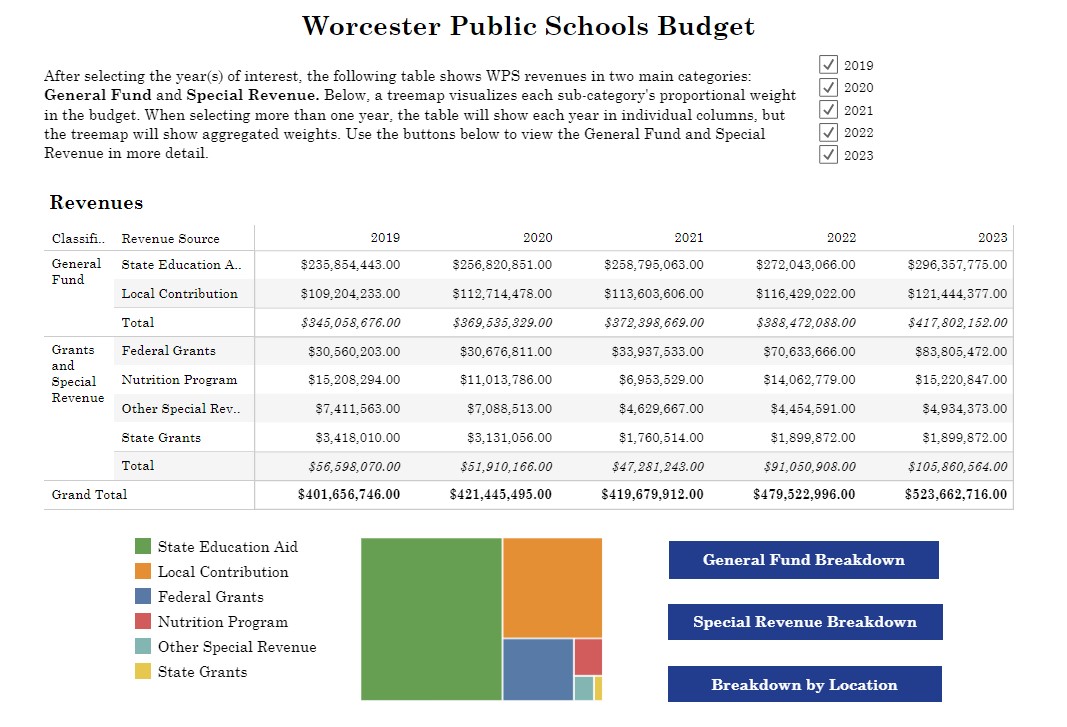

| Investing in Excellence | The yearly budget of the Worcester Public Schools is complicated, and necessarily so. With 23,735 students and 5,149 employees spread across 46 schools, there are many moving parts of which to take account. | October 13, 2022 | education finance the-excellence-series visualizations | ||

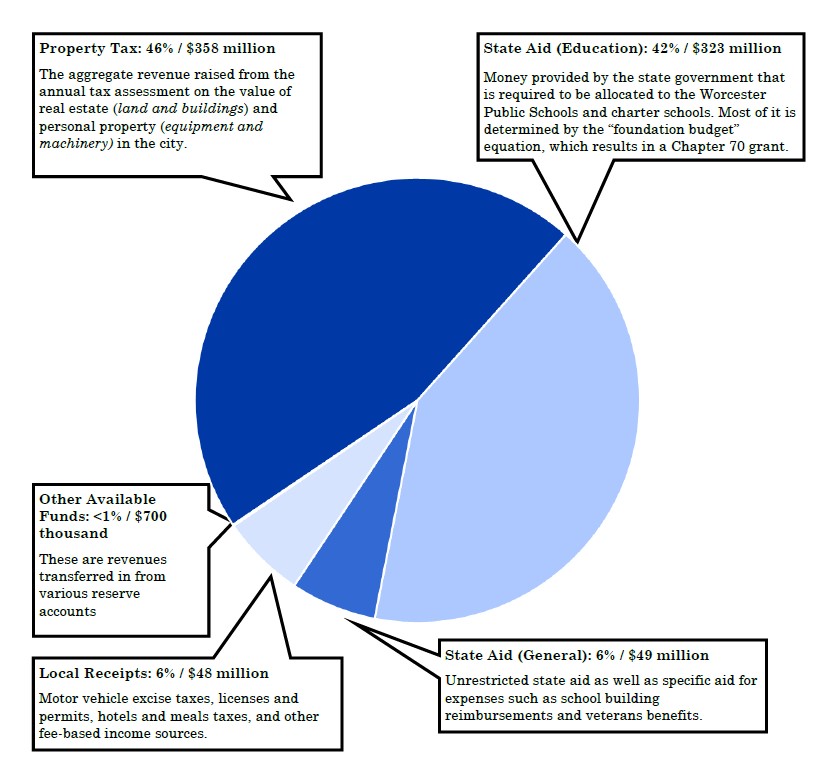

| Breaking Down the Budget: City of Worcester and Worcester Public Schools for Fiscal Year 2023 | EACH YEAR on July 1, Massachusetts cities and towns must implement a new budget. The City of Worcester’s Fiscal Year 2023 (FY23) budget took effect on July 1, 2022. | September 15, 2022 | finance series-breaking-down-the-budget | ||

| Worcester Almanac: 2022 | Worcester Almanac: 2022 compiles data from the most reliable sources to provide vital statistical information to equip decision-makers and the general public on important areas of interest. | October 3, 2022 | worcester-almanac | ||

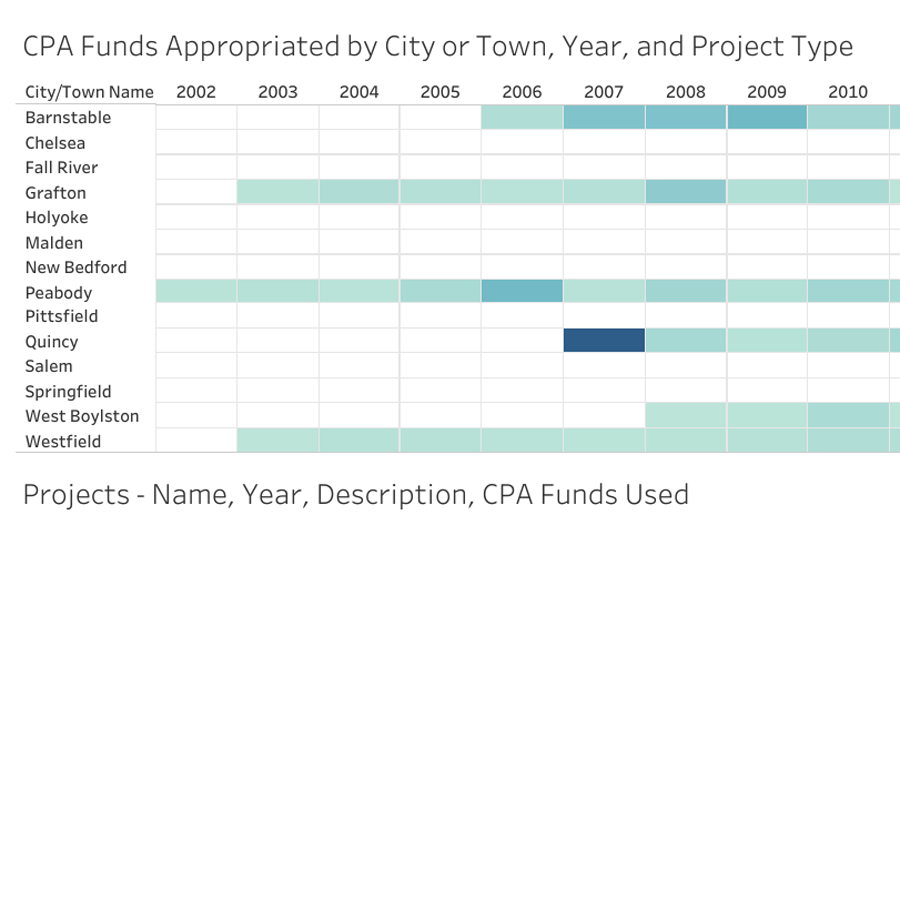

| Preserving Worcester’s Past, Present, and Future? Statewide Lessons for Worcester Voters on the CPA | Due to a coalition of local organizations and a vote by the City Council, Worcester voters this November will have the chance to adopt a 1.5 percent property tax surcharge for the purposes of funding community preservation projects. | August 2, 2022 | civic-engagement housing municipal-operations visualizations | ||

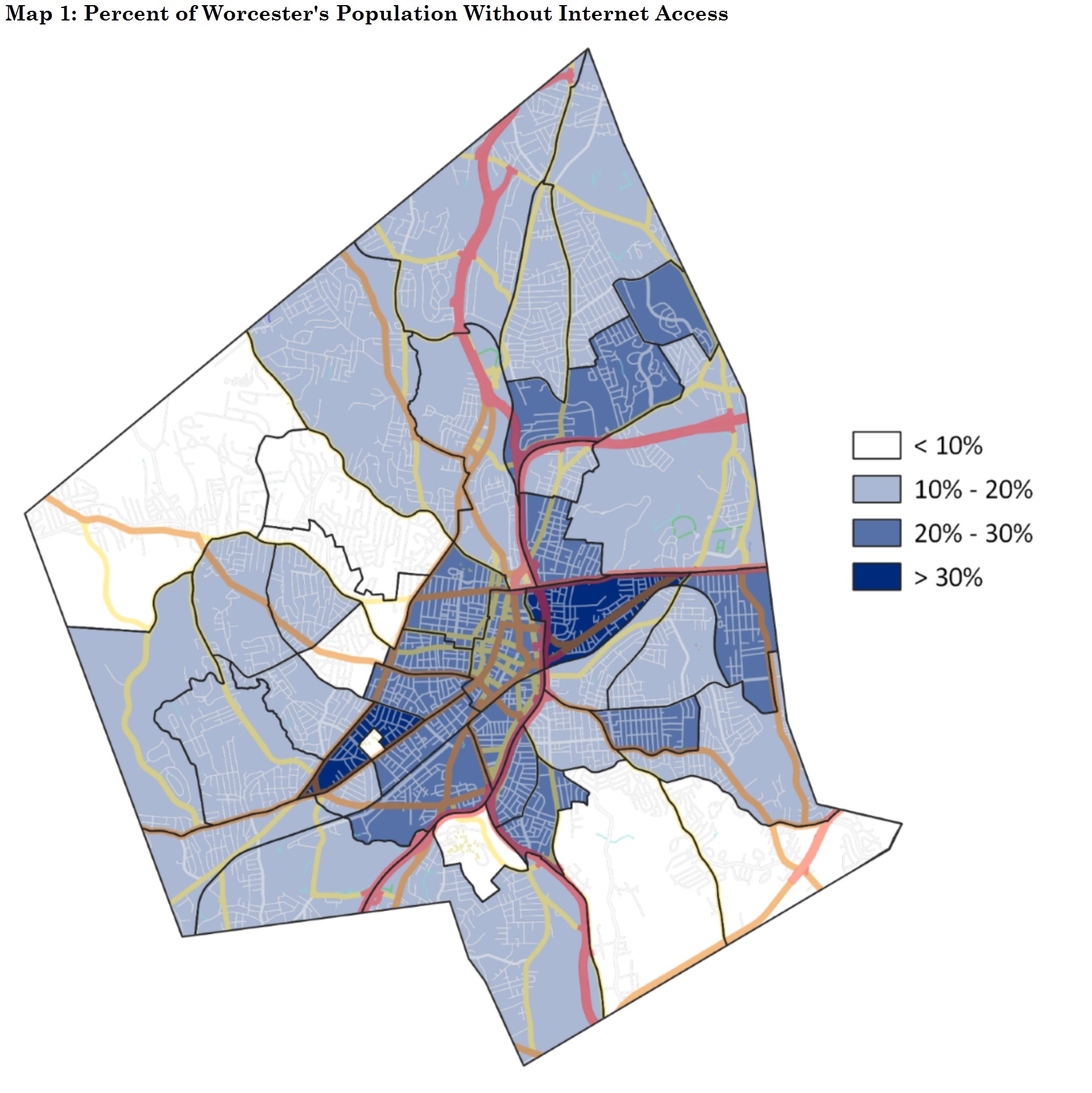

| Boosting Broadband: Access, Performance, Improvements, and Funding | This document expands on that report, by looking at three years of data, examining internet connection speed, and WPS student access. | April 28, 2022 | economic-development municipal-operations technology visualizations | ||

| Worcester Almanac: 2021 | The Worcester Regional Research Bureau is pleased to present the seventh annual Worcester Almanac—our compendium of information of all things Greater Worcester. | December 7, 2021 | worcester-almanac | ||

| Bureau Brief— Changing the Worcester School Committee to District Representation | Currently, the City of Worcester’s municipal Charter calls for the School Committee to be composed of “the mayor, who shall chair the committee and six members elected at-large.” | November 22, 2021 | civic-engagement elections public-administration | ||

| Questions for the 2021 Candidates for City Council and School Committee in Worcester | This publication is intended to provide candidates and residents in Worcester, Massachusetts with questions for consideration on key topics impacting the community and government. | October 6, 2021 | series-questions-for-the-candidates | ||

| Breaking Down the Budget: City of Worcester and Worcester Public Schools for Fiscal Year 2022 | Each year on July 1, Massachusetts cities and towns must implement a new budget. The City of Worcester’s Fiscal Year 2022 (FY22) budget takes effect on July 1, 2021. | September 15, 2021 | finance series-breaking-down-the-budget | ||

| Achieving the American Dream | The American Dream is a nebulous concept—success looks like different things to different people. But one relative constant is the concept of homeownership. | May 24, 2021 | economic-development housing | ||

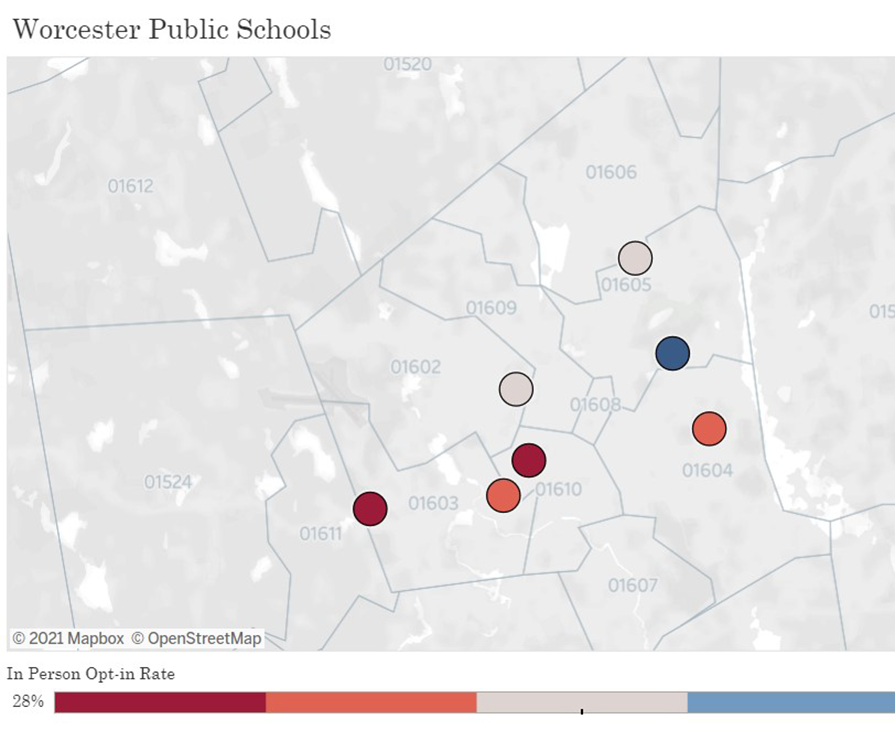

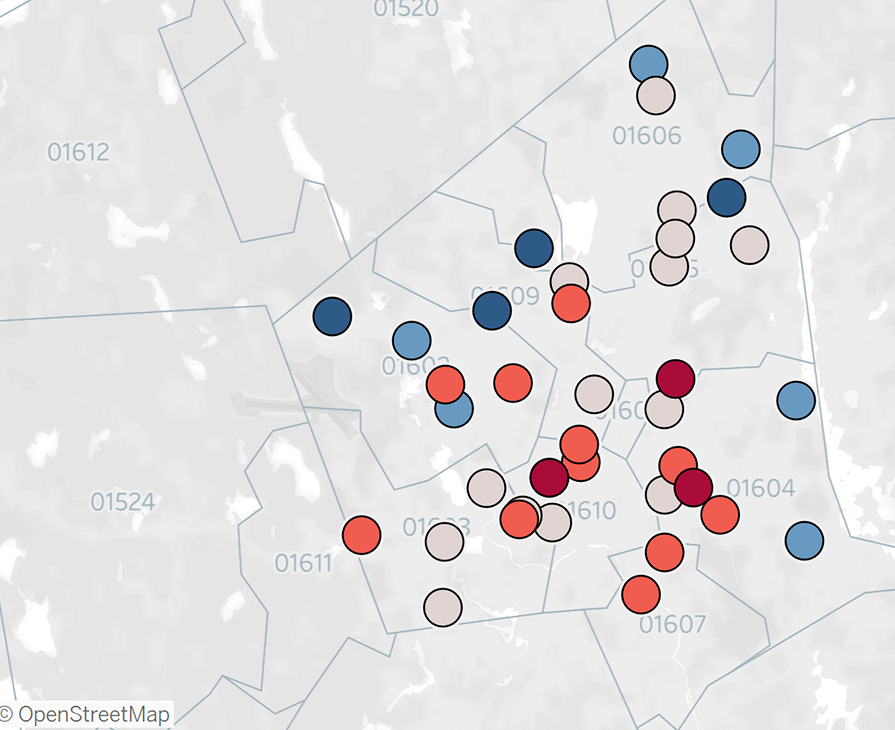

| Bureau Brief – High School In-person Learning Opt-in Rates in Worcester Public Schools | On May 17, 2021, Worcester Public Schools (WPS) will resume offering full in-person learning for grades 9-12. | May 18, 2021 | education visualizations | ||

| Bureau Brief – In-person Learning Opt-in Rates in Worcester Public Schools | On May 3, Worcester Public Schools (WPS) will resume offering full in-person learning for all grades up to grade 8. Families can opt in to in-person learning or can choose to remain with remote learning. | May 3, 2021 | education visualizations | ||

| Bureau Brief—Hybrid Learning Opt-in Rates in Worcester Public Schools | Some parents may be eager to send their children back to school for real or perceived improvements in educational quality, while others may hold back because of a belief that the risk of contracting or spreading COVID-19 remains too high to risk classroom situations. | March 26, 2021 | education visualizations | ||

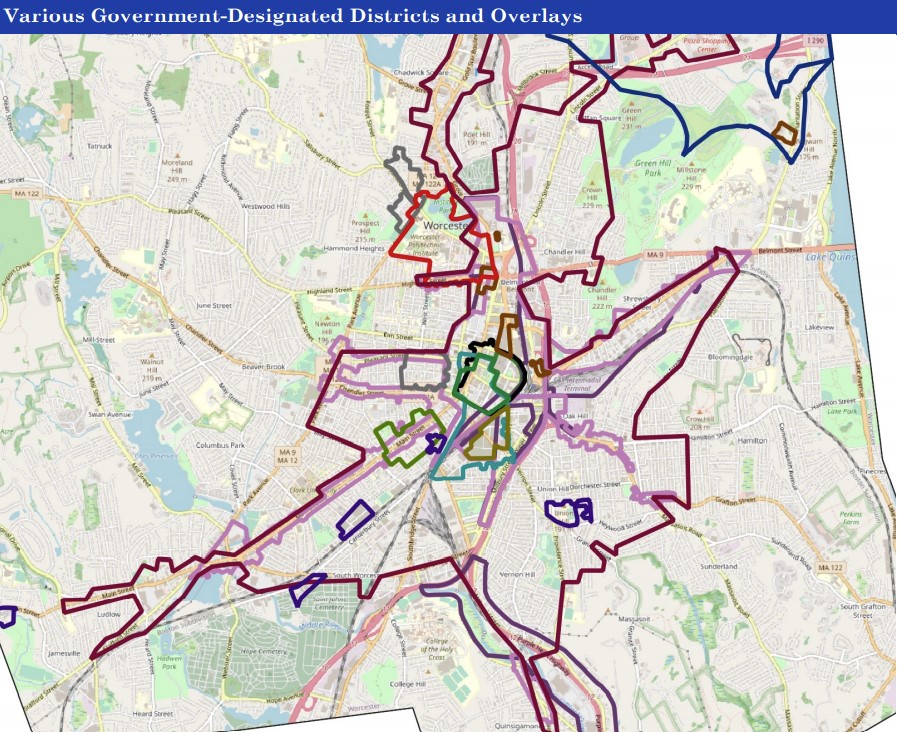

| Worcester’s Zones, Districts and Overlays | This report catalogues many of Worcester’s official zones, districts, overlays and areas. Where available, information is taken from the City of Worcester’s Geographic Information System department. The intention is for those interested in Worcester to gain a better understanding of the underlying map that governs the structure and function of the world around them. | March 17, 2021 | economic-development housing | ||

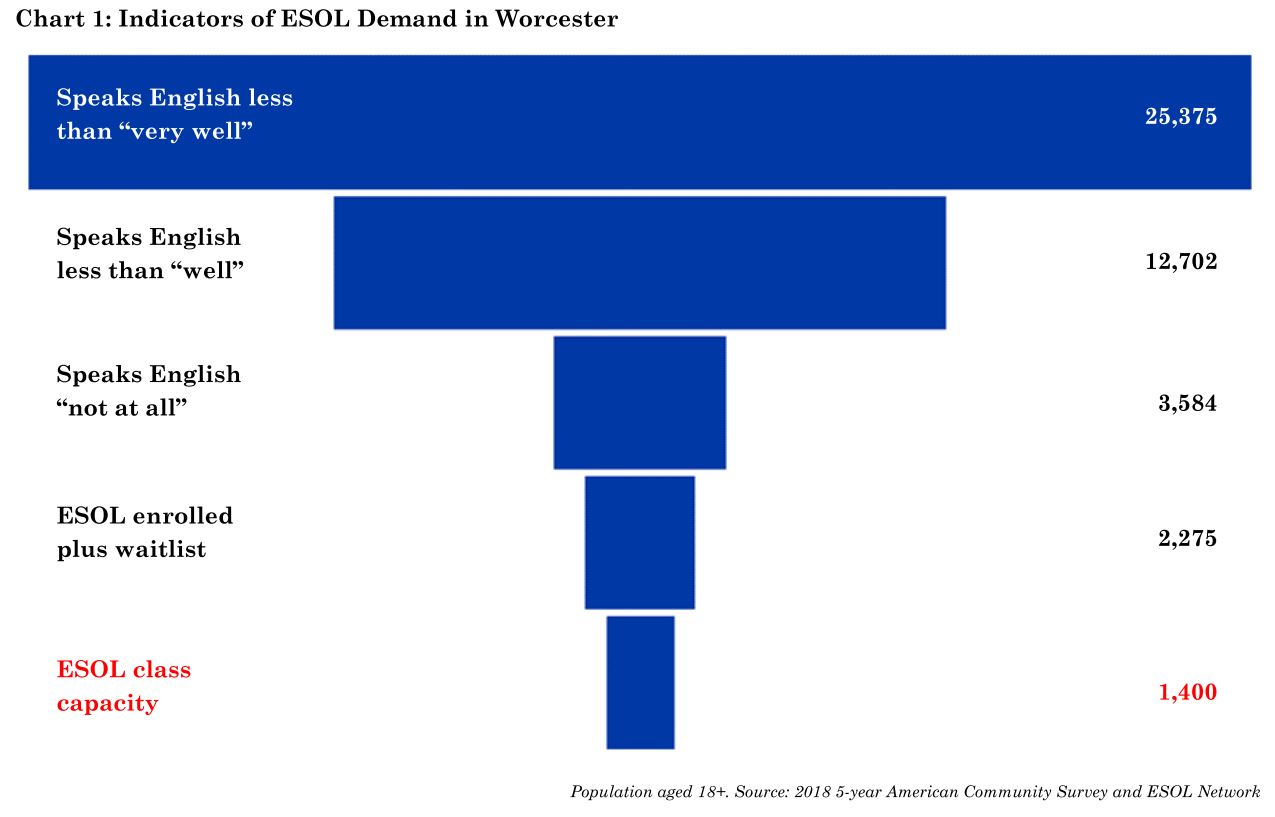

| Bureau Brief – English for Speakers of Other Languages | Adults who do not speak English well or at all are a substantial part of the Worcester population, and the classes and organizations that serve them struggle for resources. Making ESOL classes readily available to anyone is important for a number of unquantifiable reasons, but also for measurable economic reasons, making the issue a priority for further research and additional resources. | November 17, 2020 | economic-development | ||

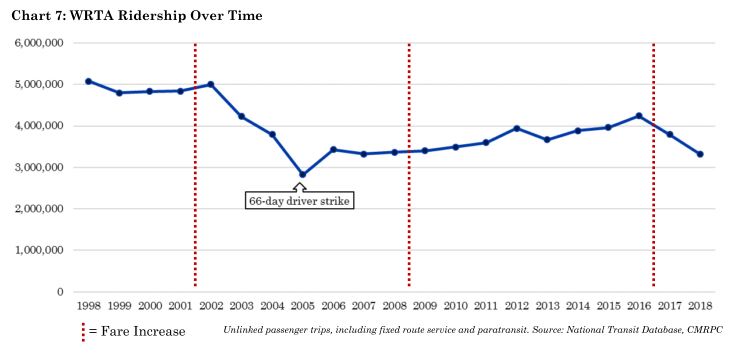

| Bureau Brief – Addendum to “Implications of a Fare-Free WRTA” | In May 2019, the Worcester Regional Research Bureau published a report analyzing the Worcester Regional Transit Authority’s fare policy, providing facts and figures on ridership, collection costs, service zone demographics and more. | November 10, 2020 | economic-development transportation | ||

| A Top Shelf Liquor License Policy | Many of Massachusetts’ thriving commercial corridors were built on rivers of liquor. Bars and restaurants can turn a neighborhood into a destination for any combination of nightlife, fine dining, culture or tourism. | October 22, 2020 | economic-development | ||

| Breaking Down the Budget & COVID’s Impacts: City of Worcester and Worcester Public Schools for Fiscal Year 2021 | EACH YEAR on July 1, Massachusetts cities and towns must implement a new budget. The City of Worcester’s Fiscal Year 2021 (FY21) budget takes effect on July 1, 2020. Municipal budgets must balance—expenditures cannot exceed revenues. | September 29, 2020 | finance | ||

| Worcester Almanac: 2020 | The Worcester Regional Research Bureau is pleased to present the sixth annual Worcester Almanac—our compendium of information of all things Greater Worcester. A local, not-for-profit organization, The Research Bureau’s mission is to serve the public interest of Greater Worcester by conducting independent, non-partisan research and analysis of public policy issues to promote informed public debate and decision-making. | August 31, 2020 | worcester-almanac | ||

| Broadening Broadband | The COVID-19 pandemic has forced community leaders, in Worcester and across the country, to look at existing systems in new ways – education, retail businesses, telecommuting and other mainstays have been reevaluated in the face of social distancing and quarantines. One system at the heart of many ongoing and proposed changes is internet service. | July 7, 2020 | economic-development municipal-operations technology | ||

| Absent Voters | Worcester voters and the elections they decide are enigmatic. Lacking the intense media coverage of state and national races or the consultants and analysts that characterize larger contests, the municipal electoral process is shrouded in relative mystery. | March 5, 2020 | civic-engagement | ||

| Downtown Office Occupancy Report | Of all the factors that influence the business climate in Worcester’s Central Business District (CBD), the office space market is one of the most basic, but also one of the most important. The physical locations available are critical both in attracting and retaining employers, and in measuring the health of the CBD. | February 27, 2020 | economic-development | ||

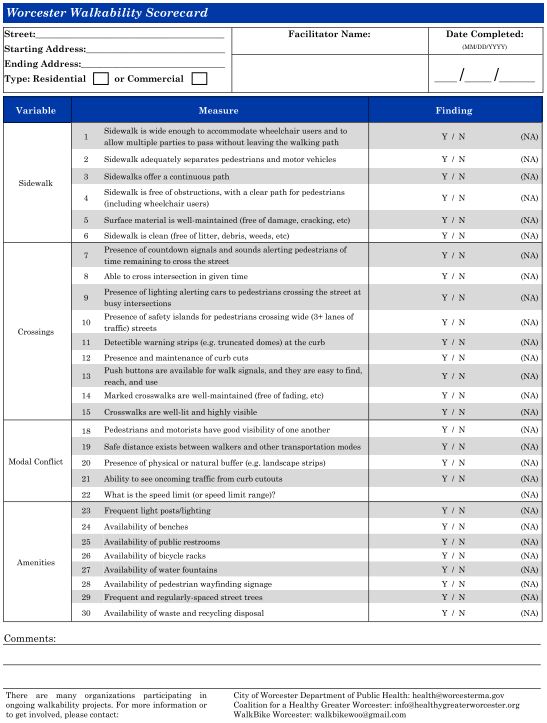

| Bureau Brief — Walkability | Walkability has numerous benefits, but how walkable an area is can be hard to quantify—while people have good intuitions about whether their neighborhood lends itself well to casual strolls, or how many destinations are easily reachable on foot, it can be harder to put those thoughts and feelings into a context that could inform public policy. | January 3, 2020 | municipal-operations transportation | ||

| Breaking Down the Budget: Questions to Consider – City of Worcester & Worcester Public Schools FY2020 | EACH YEAR on July 1, Massachusetts cities and towns must implement a new budget. The City of Worcester’s Fiscal Year 2020 (FY20) budget takes effect on July 1, 2020. | October 9, 2019 | finance series-breaking-down-the-budget | ||

| Questions for the 2019 Candidates for City Council and School Committee in Worcester | This publication is intended to provide candidates and residents in Worcester, Massachusetts with questions for consideration on key topics impacting the community and government. | September 11, 2019 | civic-engagement series-questions-for-the-candidates | ||

| The Implications of a Fare-Free WRTA | The Worcester Regional Transit Authority (WRTA), like many bus systems, suffers from low and declining ridership. There is research and evidence from other cities that going fare-free – not merely lowering fares, but eliminating them entirely – is perhaps the most effective ridership-boosting tool available to bus systems. | May 22, 2019 | economic-development finance transportation | ||

| Worcester Almanac: 2019 | The Worcester Regional Research Bureau is pleased to present the fifth annual Worcester Almanac—our compendium of information of all things Greater Worcester. A small, not-for-profit organization, The Research Bureau’s mission is to serve the public interest of Greater Worcester by conducting independent research and analysis of public policy issues to promote informed public debate and decision-making. | March 29, 2019 | worcester-almanac | ||

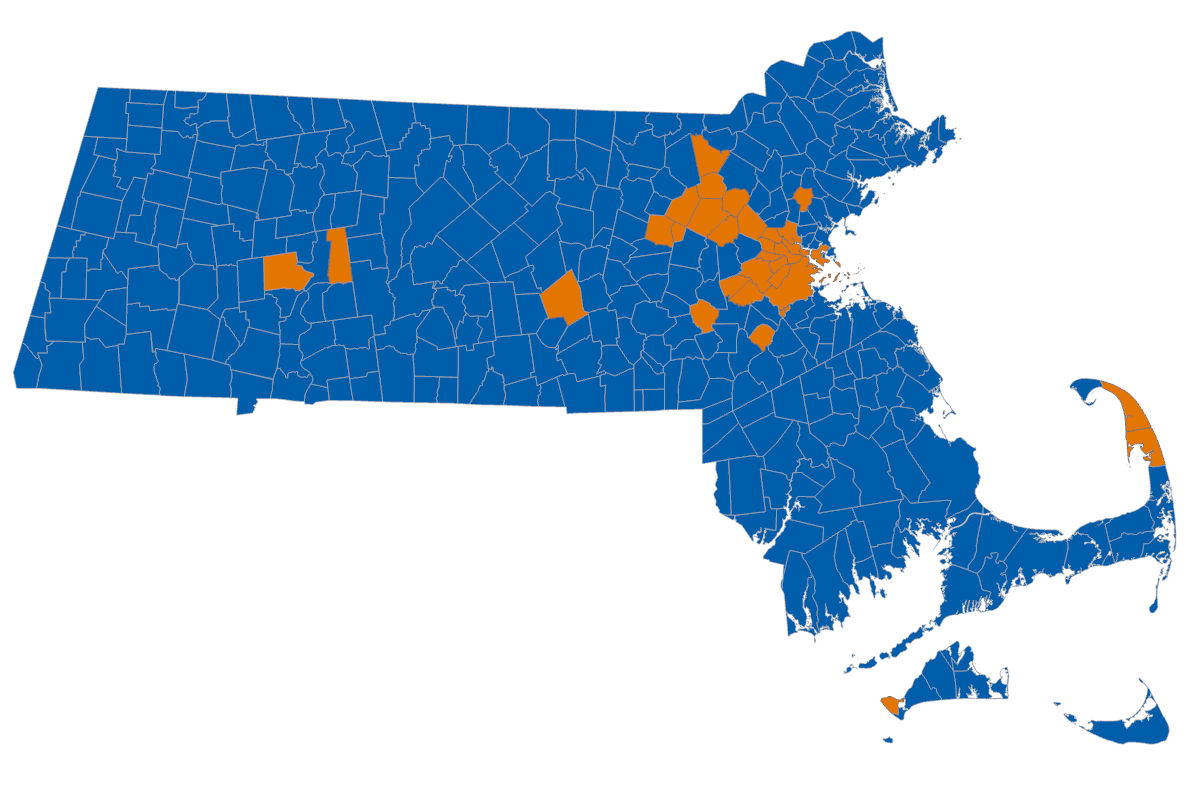

| Bureau Brief – Chapter 70 Reform | The Massachusetts Education Reform Act of 1993, codified under Chapter 70 of the Massachusetts General Laws, was adopted to ensure that every child in the Commonwealth had access to an adequately funded public school education. | March 21, 2019 | education finance | ||

| Choosing a Better Voting System: The Argument for Ranked Choice Voting in Worcester and Beyond | Ranked choice voting, or RCV, is a system that allows voters to indicate a preference not just for their first choice for an office, but for their second and third choices, and so on. Much like runoff elections, the system ensures that no one wins without more than 50 percent of the final vote. | February 28, 2019 | civic-engagement | ||

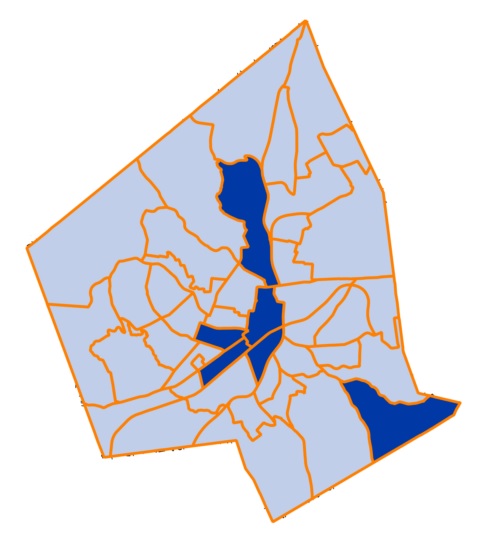

| Opportunity Zones in Worcester: Characteristics of Worcester’s Designated Areas | The Opportunity Zone program was created by the Tax Cuts and Jobs Act of 2017. It provides tax deferments and forgiveness to investors who support projects in designated areas. This investment must come from capital gains and has multiple conditions attached in an effort to benefit, specific, low-income areas. | January 8, 2019 | economic-development housing | ||

| Bureau Brief: Worcester Housing Authority | The Worcester Housing Authority (WHA) has been providing affordable housing options to Worcester residents since 1949. Federal guidelines recommend that households spend no more than 30 percent of income on rental or mortgage payments. | December 21, 2018 | housing | ||

| Bureau Brief—Trash, Recycling, and Yard Waste Removal | From 1872 to 1932, trash removal in Worcester was the responsibility of over 8,000 pigs eating 10 tons of trash per day at the nation’s largest municipal piggery. Smell complaints ultimately forced the city to shut down the piggery and build an incinerator. | November 26, 2018 | finance municipal-operations | ||

| The Immigrant Entrepreneur in Worcester | The Research Bureau, as part of a partnership with the Worcester Business Journal, is pleased to present its latest report The Immigrant Entrepreneur in Worcester. | November 9, 2018 | economic-development | ||

| Tracking City Equipment: How Expanded GPS Monitoring Could Benefit Worcester | The Research Bureau is pleased to present its latest report: Tracking City Equipment: How Expanded GPS Monitoring Could Benefit Worcester. | October 30, 2018 | municipal-operations technology | ||

| City on the Move: An Overview and Assessment of Worcester’s Transportation Needs | A transportation center for centuries, Worcester has aggressively developed connections to the outside world. By land, air, and (if only for a few decades via the Blackstone Canal) by sea, Worcester has invested in the infrastructure necessary to move people and goods in and out of the city. | September 28, 2018 | municipal-operations transportation | ||

| Breaking Down the Budget: Questions to Consider, City of Worcester & Worcester Public Schools FY2019 | EACH YEAR on July 1, Massachusetts cities and towns must implement a new budget. The City of Worcester’s Fiscal Year 2019 (FY19) budget took effect on July 1, 2018. | August 21, 2018 | finance series-breaking-down-the-budget | ||

| The Community Preservation Act | The Massachusetts Community Preservation Act (CPA) authorizes municipalities to apply a surcharge on property taxes to generate funds for open space, historic preservation, affordable housing, and outdoor recreation. | June 22, 2018 | economic-development municipal-operations | ||

| Worcester Almanac: 2018 | The Research Bureau is pleased to present The Worcester Almanac. Now in its fourth edition, it is a compendium of information of all things Greater Worcester. The Worcester Almanac offers information on local government, demographics, the economy, public safety, education, health, arts and culture, and much, much more. | April 2, 2018 | worcester-almanac | ||

| Brokering a New Lease: Capturing the Value of State Offices for Massachusetts | Boston’s economic boom has been a boon for developers and landlords, as an influx of businesses means more demand for office space and a corresponding rise in rents. Among those organizations fighting for space downtown is the state government, which leases offices across the state for its various department and agencies, but concentrates 35 percent of that square footage in the City of Boston. | March 19, 2018 | economic-development | ||

| To Protect Lives and Property: The Role of the Worcester Fire Department in Emergency Medical Services | The Research Bureau is pleased to present its latest report To Protect Lives and Property: The Role of the Worcester Fire Department in Emergency Medical Services. The job of a firefighter has changed dramatically since the Worcester Fire Department (WFD) was established in 1835. | February 13, 2018 | finance health municipal-operations public-safety | ||

| Minimizing Risk: The Implications of a $15 Minimum Wage for Worcester | The Research Bureau is pleased to present its latest report Minimizing Risk: The Implications of a $15 Minimum Wage for Worcester. While there is evidence both for and against an increased minimum wage from states and cities across the country, this report examines the potential local impact of a change on Worcester and offers thoughts on how the minimum wage can best serve the local economy and populace. | January 18, 2018 | economic-development | ||

| Foreclosure in the City of Worcester | The Research Bureau is pleased to present its latest report Foreclosure in the City of Worcester. This report explores Worcester’s recent experience with foreclosures and offers insights into the process. Foreclosure is a necessary part of a real estate market. Yet efforts must be made to limit its impact on households and neighborhoods alike. | October 4, 2017 | housing | ||

| Breaking Down the Budget: Questions to Consider, City of Worcester & Worcester Public Schools FY2018 | EACH YEAR on July 1, Massachusetts cities and towns must implement a new budget. The City of Worcester’s Fiscal Year 2018 (FY18) budget takes effect on July 1, 2018. Municipal budgets must balance—expenditures cannot exceed revenues. | October 2, 2017 | finance series-breaking-down-the-budget | ||

| Bureau Brief – Urban Design | A well-designed city, or district within a city, draws residents and visitors into public spaces, building community and supporting businesses and economic development. Many cities recognize the value of good design, but their degree of commitment and capacity for planning and regulation, as well as the level of community concern and participation, vary greatly. | September 18, 2017 | municipal-operations | ||

| Questions for the 2017 Candidates for City Council and School Committee in Worcester | In preparation for the upcoming elections for Mayor, City Council, and School Committee, The Research Bureau has prepared a set of questions for the candidates. The questions cover a broad range of issues and are meant to challenge the candidates and the public to think about key issues facing the City today and in the coming years. | September 7, 2017 | civic-engagement series-questions-for-the-candidates | ||

| How Am I Doing?” Municipal Employee Performance Evaluations | This report explores national studies and local practices, resulting in a series of recommendations for Greater Worcester cities and towns on the adoption and implementation of an employee evaluation system. | July 10, 2017 | municipal-operations | ||

| A Research Bureau Policy Alternative: Tax Rates | In order to further the Worcester City Council’s deliberations on tax policy, The Research Bureau is pleased to present a White Paper on criteria for consideration in preparation of annual tax rate determinations and alternatives to secure a more equitable single tax rate. | May 23, 2017 | finance | ||

| Worcester Almanac: 2017 | The Worcester Regional Research Bureau is pleased to present the third annual Worcester Almanac—our compendium of information of all things Greater Worcester. A small, not-for-profit organization, The Research Bureau’s mission is to serve the public interest of Greater Worcester by con-ducting independent research and analysis of public policy issues to promote informed public debate and decision-making. | March 29, 2017 | worcester-almanac | ||

| Other Post-Employment Benefits (OPEB): Holding Government Liable | In Massachusetts, state and local government retirees are eligible for pension and other post-employment benefits (OPEB), such as health care. Since these obligations are accrued daily but not due for decades in some cases, policymakers discount the cost and ultimately push the expense onto future generations. | February 28, 2017 | finance municipal-operations | ||

| Bureau Brief — Tax Increment Financing | In Massachusetts, municipalities have limited tools to entice businesses to locate and expand in a weak marketplace. The most frequently used alternative is the Economic Development Incentive Program (EDIP) and its tax increment financing (TIF) initiative. | January 31, 2017 | finance | ||

| Tax Classification: Passing the Buck$ | Since 1984, the City of Worcester has set residents against businesses in an annual duel over property tax rates. As municipal budgets continue to grow, a zero-sum game exists in which a decrease in taxes on one property class necessitates an increase in taxes on another. | November 15, 2016 | finance | ||

| Parking in Worcester: Left by the Curb | With over 5,000 public parking spaces in Downtown Worcester, parking – and its location, condition, design, and cost – is an important concern of municipal government. Parking in Worcester: Left by the Curb urges the City to elevate the discussion of parking by creating a Parking Division that reports directly to the Commissioner of Public Works & Parks. | June 30, 2016 | municipal-operations | ||

| Breaking Down the Budget: Questions to Consider, City of Worcester & Worcester Public Schools FY2017 | The Research Bureau offers its annual Breaking Down the Budget: Questions to Consider – a summary and analysis of the City of Worcester and Worcester Public Schools Fiscal Year 2017 Budgets, which go into effect on July 1, 2016. | June 28, 2016 | finance series-breaking-down-the-budget | ||

| The Every Student Succeeds Act (ESSA) | The Every Student Succeeds Act (ESSA) was signed into law by President Barack Obama in December of 2015 and reauthorizes the Elementary and Secondary Education Act (ESEA) first signed into law by President Lyndon Johnson in 1965. Like its predecessors, ESSA provides federal funding for elementary and secondary school students, emphasizes equal opportunity to learning, and sets high standards for achievement and accountability. | April 11, 2016 | education finance | ||

| The Massachusetts Foundation Budget | This primer is drawn from and summarizes the key findings and recommendations of the Foundation Budget Review Commission. The report, issued 30 October 2015, represents more than a year of work by the 21 members of the Commission. Members and staff of the Commission are noted in Appendix B. | April 11, 2016 | education finance | ||

| Worcester Almanac: 2016 | The Research Bureau is pleased to present the 2016 Worcester Almanac, the second edition of this annual compendium of information about Greater Worcester. The Almanac offers information on local government, demographics, the economy, public safety, education, health, arts and culture, and much, much more. We look closely at the current state of our region as well as some of the trends that have led us here. | March 31, 2016 | worcester-almanac | ||

| Bureau Brief—Talent Retention 2016 | The City of Worcester and the surrounding communities are home to 12 colleges and over 30,000 college students, giving Greater Worcester a built-in advantage in attracting and retaining a highly talented and educated workforce—a necessary component of successful economic development. | March 31, 2016 | economic-development | ||

| Bureau Brief—Open Government in Massachusetts | In honor of Sunshine Week, The Research Bureau offers a brief overview of public access to government in Massachusetts and considerations for improvement. | March 21, 2016 | municipal-operations | ||

| Bureau Brief—Worcester Regional Airport (ORH) | Worcester Regional Airport, airport code ORH, was founded in 1946 as a municipal airport. Over the years it has enjoyed periods of great success, peaking at 354,000 passenger enplanements in 1989, and periods of quiescence with the departure of major national airlines in the late 1990s. | February 16, 2016 | transportation | ||

| The Urgency of Excellence: Considerations for the School Committee and New Superintendent of Schools in Worcester | The Urgency of Excellence: Considerations for the School Committee and New Superintendent of Schools in Worcester is a report of the Worcester Education Collaborative (WEC) and Worcester Regional Research Bureau (WRRB). | January 12, 2016 | education public-administration | ||

| Bureau Brief—Massachusetts Comprehensive Permit Act—Chapter 40B | Massachusetts General Laws Chapter 40B was adopted in 1969 as part of the Massachusetts Comprehensive Permit Act to encourage and facilitate the building of affordable, long term housing for low-income individuals and families across the Commonwealth and to ensure that low-income residents can remain in their localities if housing costs increase. | November 23, 2015 | housing | ||

| Bureau Brief — Park Conservancies | The City of Worcester is home to a significant number of public parklands, but available funding has not kept pace with park expansion and needed maintenance. This brief reviews the potential of park conservancies – private non-profit entities that assume management and maintenance of public parklands – to improve Worcester’s signature parks and create new opportunities for public engagement. | November 9, 2015 | municipal-operations | ||

| Breaking Down the Budget: Questions to Consider, City of Worcester & Worcester Public Schools FY16 | Each July 1, the City of Worcester and Worcester Public Schools begin a new fiscal year. Who sets the priorities and how is the budget developed? How much money are we really talking? Read Breaking Down the Budget: Questions to Consider to improve your understanding of the City’s FY16 budget. | September 8, 2015 | finance series-breaking-down-the-budget | ||

| Questions for the 2015 Candidates for City Council and School Committee in Worcester | In preparation for the upcoming elections for Mayor, City Council, and School Committee, The Research Bureau has prepared a set of questions for the candidates. The questions cover a broad range of issues and are meant to challenge the candidates and the public to think about key issues facing the City today and in the coming years. | September 4, 2015 | elections series-questions-for-the-candidates | ||

| Bureau Brief — Flag Etiquette | Continental Congress—June 14, 1777 | July 2, 2015 | civic-engagement | ||

| Bureau Brief—Community Dialogues on Race—Economic Development | According to the U.S. Census Bureau, the City of Worcester has a population of 181,901 residents, making it the 129th largest city in the United States and the 2nd largest city in New England. | June 30, 2015 | economic-development series-community-dialogues-on-race | ||

| Bureau Brief—Community Dialogues on Race—Youth & Education | According to the U.S. Census Bureau, the median age of Worcester residents is 33.6 years old. The median age of Massachusetts is 39.2 and the median age of the United States is 37.3. | June 30, 2015 | education series-community-dialogues-on-race | ||

| Bureau Brief—Community Dialogues on Race—Public Safety | Research in the Public Interest. | June 11, 2015 | public-safety series-community-dialogues-on-race | ||

| Bureau Brief—Community Dialogues on Race—Representative Government | The City of Worcester, as established by the City Charter, is known as a modified Plan E form of government which is a Council-Manager form of government with a popularly elected Mayor. The Worcester Public Schools is a quasi-independent department of the City. | June 1, 2015 | municipal-operations series-community-dialogues-on-race | ||

| Bureau Brief – Immigrants & Refugees in Worcester | Over the years, Worcester has been home to many foreign-born residents. Since 1980, the City has experienced a renewal in the arrival of immigrants and refugees. | May 27, 2015 | municipal-operations | ||

| Bureau Brief—Worcester’s Unfunded OPEB Liability | The City of Worcester, like most municipalities, has struggled with outstanding pension and other post-employment benefit (OPEB) liabilities. While the City is engaged on a plan to fund its pension obligations by 2032, there is no plan in place to address the more than $727 million owed for OPEB, which mainly consists of retiree health care costs. | April 23, 2015 | finance municipal-operations | ||

| Don’t Boo. Just Remember to Vote. | While citizen participation is the basis for a strong democracy, key indicators illustrate a troubling trend for civic engagement in the City of Worcester. Low voter turnout, limited competition for local elected offices, and lackluster interest in serving on local boards and commissions indicate a disconnect between residents and local government. At Worcester Technical High School’s June 2014 Commencement Exercises President Barack Obama challenged the crowd with “Don’t Boo. Just Remember to Vote.” | April 21, 2015 | civic-engagement | ||

| Bureau Brief—The Role of the Media in Civic Life | The media plays a critical role in society, recording history, delivering information, analyzing issues, and highlighting the use and abuse of power. It is a vehicle for sharing, and debating, public opinions. Yet newspapers and other forms of media are also a business. | April 8, 2015 | civic-engagement | ||

| Bureau Brief—Non-Profits and Municipal Authority | Non-profit organizations are recognized as important elements in a community’s social, cultural, educational, and civic framework. As such, they are given unique rights under both Federal and State law. These rights exempt them from certain municipal regulations and obligations. Our latest Bureau Brief – Non-Profits and Municipal Authority reviews a non-profit’s exceptional status when it comes to local control. | February 27, 2015 | municipal-operations | ||

| Worcester Almanac: 2015 | Beginning in 2015, The Research Bureau will provide the Greater Worcester community with an annual compendium of information about the City and the region. The Worcester Almanac: 2015 is the inaugural effort to capture key data points about the area. | February 12, 2015 | worcester-almanac | ||

| The Changing City – Starting a Conversation | Worcester’s population is changing. Since 1950, Worcester’s non-white population has grown substantially, fueled in part by immigration from South America, Africa, and Asia. Nearly 20% of Worcester’s residents reside in linguistically isolated households, meaning all members of the household age 14 or over have at least some difficulty speaking English. | November 5, 2014 | |||

| Bureau Brief—The Changing City—Starting a Conversation | As a Massachusetts “Gateway City,” Worcester has welcomed residents from diverse backgrounds for decades. Prior to 1950, most new residents were born in or descended from European countries. Since 1950, the city began to attract greater numbers of residents from South America, Africa, and Asia. How has the face of Worcester changed over the last few decades? How has civic life changed as a result of the influx of new cultures? Or has it? | November 1, 2014 | |||

| Charting Worcester’s Course | Under the City Charter, the City of Worcester has a modified Plan E form of government. As the City welcomes a new city manager, some have argued that the structure of Worcester government should change. “Charting Worcester’s Course” outlines the process necessary to revise the City Charter. | October 20, 2014 | public-administration | ||

| Bureau Brief—Urban Renewal | As the Worcester Redevelopment Authority and City of Worcester consider the establishment of a new urban renewal plan focused on the Downtown, the Research Bureau offers Bureau Brief – Urban Renewal to inform policymakers and the public of the role of the Worcester Redevelopment Authority and the powers of urban renewal. | September 3, 2014 | economic-development | ||

| Central Massachusetts Talent Retention Project: A Survey of the Class of 2014 | In the 2014 school year, over 7,500 students graduated from 12 Greater Worcester colleges and universities. These graduates represent a broad range of academic credentials and professional interests. | August 27, 2014 | economic-development | ||

| MEETING NOTES from The Research Bureau | Unable to attend our 2014 Annual Meeting? Read our Bureau Notes to learn what you missed. | June 5, 2014 | municipal-operations | ||

| Breaking Down the Budget: Questions to Consider, City of Worcester & Worcester Public Schools FY15 | Each July 1, the City of Worcester and Worcester Public Schools begin a new fiscal year. Who sets the priorities and how is the budget developed? | June 1, 2014 | finance series-breaking-down-the-budget | ||

| Toward a Common Understanding of the Common Core | The current debate about educational standards and assessments has forced government officials, educators, parents, and students to take a serious look at the American education system and evaluate what students should know in order to be prepared for college and careers in the global economy. | May 1, 2014 | education | ||

| Bureau Brief—The City Manager Search Process | In support of the City Council’s efforts to identify and hire a permanent city manager, The Research Bureau provides this Bureau Brief – The City Manager Search Process, an update to prior reports on best practices for recruiting a city manager. | April 1, 2014 | public-administration | ||

| Bureau Brief—The Common Core State Standards | The Research Bureau is pleased to release its latest Bureau Brief – a short overview of the Common Core state educational standards. | April 1, 2014 | education | ||

| Worcester by the Numbers: Public and Charter Schools | This report, the fourth in our series Worcester by the Numbers, provides important data on the Worcester Public Schools and Charter Schools, including demographics, teacher salaries, test scores, graduation rates, and expenditures. | January 1, 2014 | education series-worcester-by-the-numbers | ||

| Questions for the 2013 Candidates for City Council and School Committee in Worcester | In preparation for the upcoming elections for mayor, city council and school committee, The Research Bureau has prepared a set of questions for the candidates. | October 1, 2013 | elections series-questions-for-the-candidates | ||

| Worcester by the Numbers: Housing and Land Use | This report, the third in our series Worcester by the Numbers, provides detailed data on the housing market, land use, and property taxes. | July 31, 2013 | economic-development housing series-worcester-by-the-numbers | ||

| Worcester’s FY14 Budget: Making Ends Meet | This report looks at Worcester’s FY14 budget of $563 million and suggest how Worcester can continue to balance its budget while facing increasing school, healthcare, and pension system costs. | June 1, 2013 | finance | ||

| Worcester by the Numbers: Economy and Jobs | This report, the second in our series Worcester by the Numbers, is generously underwritten by MassDevelopment, and focuses on Worcester’s economy and jobs during the past decade. It provides data on industries that are growing and shrinking, unemployment, wages, and number of establishments by industry. | May 21, 2013 | economic-development series-worcester-by-the-numbers | ||

| A Prescription for Retiree Health Care: How Worcester can vanquish its OPEB liability while keeping its workforce happy and healthy | This report addresses a crisis local governments are facing across the nation: how to pay for OPEB – “other post-employment benefits” that were promised to retirees in better fiscal times. | April 1, 2013 | finance health municipal-operations | ||

| Should Worcester Welcome a Slot-Machine Casino? | This report, which examines the operations and potential effects of the slots industry on the City of Worcester, was undertaken because Worcester has been designated as the preferred site for a slot-machine casino by Mass Gaming LLC, a subsidiary of Rush Gaming. | March 1, 2013 | economic-development | ||

| Worcester’s Demographic Trends: 2010 Census | This report analyzes Worcester’s demographic, education, employment, income, and other trends based on data from the 2010 Census. The data indicate fairly substantial changes in the City’s population over the past couple of decades measured by a number of different indicators. | February 11, 2013 | economic-development | ||

| Academically Selective High Schools: Should Worcester Public Schools Have One? | This report analyzes the pros and cons of academically selective high schools to determine whether the Worcester Public Schools (WPS) should establish one. | December 1, 2012 | education | ||

| Fare Play? Regulating Worcester’s Livery Vehicles and Taxis | This report discusses the regulations of Worcester’s livery vehicles and taxis. | October 1, 2012 | economic-development | ||

| Worcester’s FY13 Budget: Post-Recession Observations | This report offers a number of observations on Worcester’s FY13 municipal budget of $542 million. | June 1, 2012 | finance | ||

| Benchmarking Public Safety in Worcester: 2012 | This report looks at recent performance trends in Worcester’s police department, fire department, and emergency medical services. | May 1, 2012 | public-safety series-benchmarking-worcester | ||

| Benchmarking Economic Development in Worcester: 2012 | This report, generously underwritten by MassDevelopment, examines the economic health of the city and region from a variety of angles such as the tax base and the labor and housing markets. | March 21, 2012 | economic-development series-benchmarking-worcester | ||

| Worcester Settles with its Unions: A Review | This report examines the settlements that Worcester reached with its major collective bargaining units in spring 2011. | November 1, 2011 | municipal-operations | ||

| Downtown Worcester Office Occupancy: 2011 Survey | The Research Bureau’s annual analysis of office occupancy rates in downtown Worcester and detailed listing of office space available for lease. | October 27, 2011 | economic-development series-office-space-occupancy | ||

| Questions for the 2011 Candidates for City Council and School Committee in Worcester | In preparation for the upcoming elections for mayor, city council and school committee, The Research Bureau has prepared a set of questions for the candidates. | September 1, 2011 | elections series-questions-for-the-candidates | ||

| Benchmarking Municipal and Neighborhood Services in Worcester: 2011 | This report describes the performance of several municipal agencies including the Department of Public Works and Parks, the Department of Inspectional Services, and the Worcester Public Library, as well as measuring residents’ level of civic engagement. | July 6, 2011 | municipal-operations series-benchmarking-worcester | ||

| 10 Questions about Worcester’s FY12 Budget | In an effort to explain the major fiscal challenges that Worcester and every other community in the Commonwealth faces in FY12, and how they have been addressed, The Research Bureau presents answers to ten key questions about the City’s budget. | June 7, 2011 | finance | ||

| EPA Stormwater Regulations in Worcester: Will Ratepayers be Drained? | This report examines the controversy over Worcester’s next stormwater discharge permit from the EPA. | May 18, 2011 | municipal-operations | ||

| Benchmarking Public Education in Worcester: 2010 | This report examines student, school, and district performance in relation to the standards implemented under the Massachusetts Education Reform Act of 1993 and the Federal No Child Left Behind legislation signed into law in 2002 in an effort to close the achievement gap between subgroups of students. | October 25, 2010 | education series-benchmarking-worcester | ||

| Benchmarking Public Safety in Worcester: 2010 | This report measures the performance of Worcester’s police department, fire department, and ambulance/emergency medical services. | July 26, 2010 | public-safety series-benchmarking-worcester | ||

| Worcester Regional Airport Positioned for Take-Off | After advocating for many years the sale or lease of Worcester Regional Airport to Massport, The Research Bureau is pleased to endorse the Memorandum of Understanding (MOU) between the City and Massport for the transfer of the facility. | June 1, 2010 | transportation | ||

| Worcester’s FY11 Budget and Fiscal Crisis: No End in Sight | This report reviews the City Manager’s FY11 budget. | June 1, 2010 | finance | ||

| Benchmarking Economic Development in Worcester: 2009 | This report, generously underwritten by MassDevelopment, contains updated information for the following performance indicators: the value of the City’s tax base, property tax rates, new construction values, employment and labor force growth, the downtown office occupancy rate, and vacant, abandoned, and foreclosed properties. | November 24, 2009 | economic-development series-benchmarking-worcester | ||

| Benchmarking Public Education in Worcester: 2009 | This report examines student, school, and district performance in relation to the standards implemented under the Massachusetts Education Reform Act of 1993 and the Federal No Child Left Behind legislation signed into law in 2002 in an effort to close the achievement gap between subgroups of students. | August 1, 2009 | education series-benchmarking-worcester | ||

| Benchmarking Municipal Finance in Worcester 2009: Factors Affecting the City’s Bond Rating | This report discusses the significance of bond ratings for a municipality’s financial well-being and examines seven indicators of municipal fiscal health that are key determinants of a municipality’s bond rating. | July 27, 2009 | finance series-benchmarking-worcester | ||

| Massachusetts Pension Reform: What was accomplished? What remains to be done? | This report summarizes the most egregious public employee pension abuses that were eliminated by the recently-passed Massachusetts Pension Reform Act, but goes on to list the more costly problems with the system which are in need of reform. | July 9, 2009 | finance municipal-operations | ||

| Worcester’s FY10 Budget: Challenges and Opportunities for Reform | This report, produced annually, reviews the City Manager’s FY10 budget. | May 7, 2009 | finance | ||

| Downtown Worcester Office Occupancy: 2008 Survey | Annual analysis of downtown office occupancy rates in Worcester’s Central Business District and detailed listing of office space available for lease. | October 1, 2008 | economic-development series-office-space-occupancy | ||

| Casino Gambling in Worcester: The Case For and Against | This report considers the potential advantages and disadvantages of casino gambling for Worcester and the region. | October 18, 2007 | economic-development | ||

| Benchmarking Economic Development in Worcester: 2007 | This report contains updated information for the following performance indicators: the value of the City’s tax base, property tax rates, new construction values, employment and labor force growth, the downtown office occupancy rate, and vacant and abandoned buildings. | October 1, 2007 | economic-development series-benchmarking-worcester | ||

| Cutting to the Core: Rethinking Municipal Services in FY08 and Beyond | This report discusses the significance of bond ratings for a municipality’s financial well-being and examines seven indicators of municipal fiscal health that are key determinants of a municipality’s bond rating. | May 24, 2007 | finance | ||

| Worcester’s Bond Rating and the Recession: What’s the City’s Credit Score? | How is a bond rating for a municipality determined? Have Worcester’s borrowing costs gone up or down in the current volatile municipal bond market? | January 27, 2011 | finance | ||

| Downtown Worcester Office Occupancy: 2010 Survey | Annual analysis of downtown office occupancy rates in Worcester’s Central Business District and detailed listing of office space available for lease. Detailed Property Listing (Appendix … | December 17, 2010 | economic-development | ||

| Teachers’ Compensation Package + Worcester’s Finances = Do They Add Up? | In order to clarify what’s at stake in the stalemated contract negotiations between the Worcester School Committee and the Education Association of Worcester, this report analyzes the total compensation package for teachers under the current contract, as well as the financial condition of the Worcester Public Schools and the City. | December 10, 2010 | education | ||

| Benchmarking Economic Development in Worcester: 2010 | This report, generously underwritten by MassDevelopment, contains updated information for the following performance indicators: the value of the City’s tax base, property tax rates, new construction values, employment and labor force growth, the downtown office occupancy rate, and vacant and abandoned properties. | November 24, 2010 | economic-development series-benchmarking-worcester | ||

| Mayor’s Task Force on Job Growth and Business Retention: Task Force Report to Mayor Joseph O’Brien | In April of 2010, Mayor Joseph C. O‘Brien assembled a 36-member Task Force on Job Growth and Business Retention to address growing concerns regarding the City of Worcester‘s ability to provide its citizens with jobs that pay a living wage. | August 9, 2010 | economic-development finance | ||

| Benchmarking Municipal and Neighborhood Services in Worcester: 2010 | This report describes the performance of several municipal agencies including the Department of Public Works and Parks, the Department of Inspectional Services, and the Worcester Public Library, as well as measuring residents’ level of civic engagement. | March 29, 2010 | municipal-operations series-benchmarking-worcester | ||

| Race to the Top: What’s the Winning Strategy? | This report discusses the criteria for states to compete successfully in the Obama administration’s Race to the Top Program for public schools. | December 10, 2009 | education | ||

| Downtown Worcester Office Occupancy: 2009 Survey | Annual analysis of downtown office occupancy rates in Worcester’s Central Business District and detailed listing of office space available for lease. | November 1, 2009 | economic-development series-office-space-occupancy | ||

| Worcester Public School Facts | … | October 1, 2009 | education | ||

| Municipal Elections in Worcester 2009: Questions for the Candidates | In preparation for the upcoming municipal elections in Worcester, The Research Bureau has prepared a set of questions for the candidates. | September 24, 2009 | civic-engagement series-questions-for-the-candidates | ||

| “Public Employee Pensions: Is it Time to Retire the System?” | In his 2009 State of the State address, Governor Patrick acknowledged “abuses” in Massachusetts’ public pension system and “special benefits for a select few,” and called for “meaningful pension reform this [legislative] session.” | June 1, 2009 | finance municipal-operations | ||

| Benchmarking Public Safety in Worcester: 2009 | This report measures the performance of Worcester’s police department, fire department, and ambulance/emergency medical services. | May 1, 2009 | public-safety series-benchmarking-worcester | ||

| Public Employee Pensions: Is it Time to Retire the System? | This report examines the public pension system in Worcester and Massachusetts. | March 30, 2009 | finance municipal-operations | ||

| Measuring Downtown Worcester’s “Curb Appeal:” ComNET Results | This report complements The Research Bureau’s recently-released report, “What’s Up With Downtown Worcester?: Prospects for Revitalization.” Discussed are the results of the Downtown ComNET (Computerized Neighborhood Environment Tracking) survey, which tracks the physical condition of a neighborhood, including streets, sidewalks, and buildings. | December 12, 2008 | public-safety transportation | ||

| What’s Up With Downtown Worcester?: Prospects for Revitalization | This report discusses the progress that downtown Worcester has made over the last decade and the projects proposed for the near future. After assessing certain challenges to revitalization, The Research Bureau makes some recommendations about how to strengthen the prospects for further progress in downtown Worcester. | December 11, 2008 | economic-development | ||

| Benchmarking Economic Development in Worcester: 2008 | This report, generously underwritten by MassDevelopment, contains updated information for the following performance indicators: the value of the City’s tax base, property tax rates, new construction values, employment and labor force growth, the downtown office occupancy rate, and vacant, abandoned, and foreclosed properties. | November 24, 2008 | economic-development series-benchmarking-worcester | ||

| Benchmarking Municipal Finance in Worcester 2008: Factors Affecting the City’s Bond Rating | This report discusses the significance of bond ratings for a municipality’s financial well-being and examines seven indicators of municipal fiscal health that are key determinants of a municipality’s bond rating. | September 25, 2008 | finance series-benchmarking-worcester | ||

| Maintaining Municipal Parks: Thinking Outside the Picnic Basket | This report discusses the challenge the City faces in maintaining its parks and recreational facilities during a time of budget cuts and decreasing revenues. | August 8, 2008 | municipal-operations | ||

| Choosing a New School Superintendent to Address Worcester’s Challenges | This report discusses the challenges facing the next Superintendent of the Worcester Public Schools. | June 30, 2008 | education | ||

| Worcester’s FY09 Budget: Continuing the Reform Agenda | This report, produced annually, reviews the City Manager’s FY10 budget. | May 8, 2008 | finance | ||

| “Where have all the bidders gone?” | In recent years, there have been several public construction projects that the City of Worcester put out to bid for which very few bidders responded, and the costs associated with those bids have generally exceeded the City’s estimates. | April 1, 2008 | economic-development | ||

| Benchmarking Public Education in Worcester: 2008 | This report examines student, school, and district performance in relation to the standards implemented under the Massachusetts Education Reform Act of 1993 and the Federal No Child Left Behind legislation signed into law in 2002 in an effort to close the achievement gap between subgroups of students. | March 1, 2008 | education series-benchmarking-worcester | ||

| Where Have All the Bidders Gone?: The Impact of “Responsibility” on Public Construction | The report examines why the City of Worcester receives so few bids on public construction projects and why those bids frequently have projected costs in excess of the City’s estimates. | February 25, 2008 | economic-development | ||

| Benchmarking Municipal and Neighborhood Services in Worcester: 2007 | Sixth report describing the performance of several municipal agencies including the Department of Public Works and Parks, the Divisions of Housing and Code Enforcement, and the Worcester Public Library, as well as measuring residents’ level of civic engagement. | December 1, 2007 | municipal-operations series-benchmarking-worcester | ||

| Benchmarking Public Safety in Worcester: 2007 | Fifth report measuring the performance of Worcester’s police department, fire department, and ambulance/emergency medical services. | October 1, 2007 | public-safety series-benchmarking-worcester | ||

| Downtown Worcester Office Occupancy: 2007 Survey | This report discusses the progress that downtown Worcester has made over the last decade and the projects proposed for the near future. After assessing certain challenges to revitalization, The Research Bureau makes some recommendations about how to strengthen the prospects for further progress in downtown Worcester. | September 1, 2007 | economic-development | ||

| Benchmarking Municipal Finance in Worcester: Factors Affecting the City’s Bond Rating | This report examines six indicators of municipal fiscal health that are key determinants of a municipality’s bond rating. | May 22, 2007 | finance series-benchmarking-worcester | ||

| Improving Student Performance Under Education Reform: Practices In Urban Schools | This report examines the human and financial resources available to educate Worcester Public Schools students as well as student performance since the passage of the Massachusetts Education Reform Act (MERA) of 1993. | May 14, 2007 | education | ||

| Benchmarking Public Education in Worcester: 2007 | This report examines student, school, and district performance in relation to the standards implemented under the Massachusetts Education Reform Act of 1993 and the Federal No Child Left Behind legislation signed into law in 2002 in an effort to close the achievement gap between subgroups of students. | April 1, 2007 | education series-benchmarking-worcester | ||

| Voluntary Contributions to the City of Springfield by its Private Colleges: Findings and Suggestions | This report examines the value and nature of tax-exempt property in Springfield, the financial health of the City and the individual colleges, the services and benefits provided by the colleges to Springfield and its residents, the municipal services that the colleges use, as well as describing PILOT programs (and state local aid programs) in Massachusetts and elsewhere. | March 19, 2007 | economic-development | ||

| Citizen Satisfaction with Municipal Services and Quality of Life in Worcester: 2006 Survey | Annual survey of citizen satisfaction with municipal services. | February 1, 2007 | civic-engagement municipal-operations | ||

| Cable TV: Get With the Program | Analyzes the City of Worcester’s cable contract with Charter Communications and examines cable licenses in 14 other cities. | December 7, 2006 | municipal-operations technology | ||

| Benchmarking Economic Development in Worcester: 2006 | Sixth annual report tracking economic development in Worcester. | November 1, 2006 | economic-development series-benchmarking-worcester | ||

| Dial 911: Whose Call Is It, Anyway? | Analyzes first response to medical emergencies in Worcester and 35 other cities nationwide. | October 3, 2006 | public-safety | ||

| Benchmarking Municipal and Neighborhood Services in Worcester: 2006 | Fifth report describing the performance of several municipal agencies including the Department of Public Works and Parks, Division of Code Enforcement, and the Worcester Public Library, as well as measuring residents’ level of civic engagement. | October 1, 2006 | municipal-operations series-benchmarking-worcester | ||

| Downtown Worcester Office Occupancy: 2006 Survey | Annual analysis of downtown office occupancy rates in Worcester’s Central Business District and detailed listing of office space available for lease. | September 1, 2006 | economic-development series-office-space-occupancy | ||

| Measures of Economic Health: Springfield vs. Worcester | This analysis, prepared for the Springfield Finance Control Board, examines a wide range of factors related to the rate of tax base growth in Springfield and Worcester, including: population characteristics; property values, tax rates, new growth, and tax levies; labor force and labor market characteristics; housing prices; and public safety/crime trends. | July 1, 2006 | economic-development | ||

| Citizen Satisfaction with Municipal Services and Quality of Life in Worcester: 2005 Survey | Annual survey of citizen satisfaction with municipal services. | June 1, 2006 | civic-engagement municipal-operations | ||

| How Can Worcester Insure its Fiscal Health in FY07 and Beyond? | Suggestions for addressing projected budget shortfalls through cost controls, restructuring services, and increasing revenues. | May 16, 2006 | finance | ||

| Downtown Worcester Office Occupancy Survey 2005 | Annual analysis of downtown office occupancy rates in Worcester’s Central Business District. | December 1, 2005 | economic-development | ||

| Siting Residential Social Service Programs: The Process and the Options | Examines the impact of siting minimally-supervised residential programs for those with substance abuse problems in residential neighborhoods. | October 3, 2005 | municipal-operations | ||

| Benchmarking Municipal and Neighborhood Services: 2005 | Fourth annual report benchmarking municipal and neighborhood services. | October 1, 2005 | municipal-operations series-benchmarking-worcester | ||

| City Council Salaries and the Competitiveness of Elections: A Survey | Examines why the number of candidates running in Worcester elections has been declining since the 1980’s. | September 22, 2005 | civic-engagement finance | ||

| The FY06 Budget: Are Increasing Taxes and Reducing Services the Only Options? | Describes Worcester’s cost reductions and municipal service improvements, and offers suggestions for additional improvements. | May 16, 2005 | finance | ||

| Condition Serious, Prognosis Uncertain: The Impact of Municipal Employee Health Insurance in Massachusetts | Compares Worcester’s municipal health benefits with towns in the Worcester vicinity, 28 larger cities and towns in Massachusetts, regional and national averages, and data from private employers. | February 28, 2005 | finance health municipal-operations | ||

| Benchmarking Public Education in Worcester: 2004 | This report documents the Worcester Public Schools’ performance along several measures including attendance and dropout rates, student mobility, family involvement, post-graduate placement, and MCAS scores. | November 1, 2004 | education series-benchmarking-worcester | ||

| Downtown Worcester Office Occupancy Survey 2004 | Annual analysis of downtown office occupancy rates in Worcester’s Central Business District. | October 1, 2004 | economic-development series-office-space-occupancy | ||

| Benchmarking Municipal and Neighborhood Services: 2004 | Third annual report benchmarking municipal and neighborhood services. | August 1, 2004 | municipal-operations series-benchmarking-worcester | ||

| Benchmarking Economic Development in Worcester: 2003 | Third annual report benchmarking economic development in Worcester. Contains data on Worcester’s commercial and residential real estate market, as well as job market and labor force trends. | November 1, 2003 | economic-development series-benchmarking-worcester | ||

| The Role of Regional Planning Agencies in Facilitating Economic Development | After reviewing the work of the Pioneer Valley Planning Commission in facilitating economic development in the Pioneer Valley, the Research Bureau encourages the Central Massachusetts Regional Planning Commission to implement several recommendations. | December 18, 2002 | economic-development | ||

| Benchmarking Economic Development in Worcester: 2002 | Second annual report benchmarking economic development in Worcester. | November 1, 2002 | economic-development series-benchmarking-worcester | ||

| Benchmarking Municipal and Neighborhood Services: 2002 | Data related to a variety of City services including those provided by the Department of Public Works, the Department of Parks, Recreation, and Cemetery, and the Worcester Public Library. | May 1, 2002 | municipal-operations series-benchmarking-worcester | ||

| Benchmarking Public Education in Worcester: 2002 | This report documents the Worcester Public Schools’ performance along several measures including attendance and dropout rates, student mobility, family involvement, post-graduate placement, and MCAS scores. | February 1, 2002 | education series-benchmarking-worcester | ||

| Benchmarking Public Safety in Worcester: 2006 | Fourth report measuring the performance of Worcester’s police, fire, and ambulance/emergency medical services. | September 1, 2006 | public-safety series-benchmarking-worcester | ||

| Talent Retention Project: Central Massachusetts | Identifies correlations between talent retention and economic prosperity in the region. | May 1, 2006 | economic-development | ||

| Destination Worcester: What’s the “Convention-al Wisdom?” | Analysis of and recommendations for attracting more multi-day conventions and events to Worcester. | March 27, 2006 | economic-development | ||

| Benchmarking Public Education in Worcester: 2006 | This report documents Worcester’s performance along several measures including attendance and dropout rates, student mobility, family involvement, post-graduate placement, and MCAS scores. | March 1, 2006 | education series-benchmarking-worcester | ||

| Reorganizing Public Safety Functions: Considerations For and Against | At the request of the Worcester City Council, The Research Bureau prepared a study on the advantages and disadvantages of organizing public safety functions into a consolidated department of public safety. | December 15, 2005 | municipal-operations public-safety | ||

| Benchmarking Economic Development in Worcester: 2005 | Fifth annual report benchmarking economic development in Worcester. | November 1, 2005 | economic-development series-benchmarking-worcester | ||

| Benchmarking Youth Services in Worcester: 2005 | Documents Worcester’s youth service program performance, including data from the Worcester Public Schools and local nonprofit institutions. | June 1, 2005 | series-benchmarking-worcester | ||

| Benchmarking Public Safety in Worcester: 2005 | Third report measuring the performance of Worcester’s police, fire, and ambulance/emergency medical services. | April 1, 2005 | public-safety series-benchmarking-worcester | ||

| Mayor vs. Manager: Does Form Affect Performance? | Are there any correlations between form of government and the level of economic health and vibrancy? How does this relate to Worcester? | December 13, 2004 | public-administration | ||

| Citizen Satisfaction with Municipal Services: 2004 Survey | Third annual survey of citizen satisfaction with municipal services. | December 1, 2004 | civic-engagement municipal-operations | ||

| Benchmarking Economic Development in Worcester: 2004 | Fourth annual report benchmarking economic development in Worcester. | November 1, 2004 | economic-development series-benchmarking-worcester | ||

| The Fire Department Arbitration Decision: Implications and Options | This report discusses the 2004 Worcester firefighters’ arbitration award, the financial implications for the City of Worcester, and the options available. | August 9, 2004 | municipal-operations | ||

| Oh Manager, Where Art Thou? Best Practices for Selecting a City Manager | How to best select a city manager. | July 15, 2004 | public-administration | ||

| Worcester’s FY05 Budget: More Tough Questions | Worcester faces numerous financial challenges in its FY05 budget and beyond. | June 22, 2004 | finance | ||

| Respect for the Dead and Relief for the Budget: Can Privatization Improve Hope Cemetery? | Possible privatization of Hope Cemetery or its operations is examined. | June 3, 2004 | finance municipal-operations | ||

| Benchmarking Public Safety in Worcester: 2004 | Second report measuring the performance of Worcester’s police, fire, and ambulance/emergency medical services. | June 1, 2004 | public-safety series-benchmarking-worcester | ||

| Benchmarking Youth Services in Worcester: 2004 | Documents Worcester’s youth service program performance, including data from the Worcester Public Schools and local nonprofit institutions. | April 1, 2004 | series-benchmarking-worcester | ||

| Will PILOTs Fly in Worcester? Taxing Nonprofits and Other Options | This report examines the potential costs and benefits of a Payment in Lieu of Taxes (PILOT) program in Worcester. | March 24, 2004 | finance | ||

| Job Flight from Worcester | This report examines the economic impact of the Worcester Airport’s decline. | January 16, 2004 | economic-development | ||

| The FY04 Budget: Did Worcester Make the Tough Choices? | Examines how Worcester closed its $20+ million dollar budget gap and compares those decisions with earlier Research Bureau recommendations. | January 15, 2004 | finance | ||

| Citizen Satisfaction with Municipal Services: 2003 Survey | This presents the full data from the 2003 CCPM survey of Worcester residents regarding their satisfaction with municipal services and includes comparisons with data from previous years. | December 1, 2003 | civic-engagement municipal-operations | ||

| Education Reform and Collective Bargaining: C for Compatibility | Evaluates current collective bargaining agreement between the Worcester School Committee and the Educational Association of Worcester on how well the contract harmonizes with education reform. | October 31, 2003 | education | ||

| Benchmarking Municipal and Neighborhood Services: 2003 | Second annual report benchmarking municipal and neighborhood services. | October 1, 2003 | municipal-operations series-benchmarking-worcester | ||

| Downtown Worcester Office Occupancy 2003 | Annual analysis of downtown office occupancy rates in Worcester’s Central Business District. | September 1, 2003 | economic-development series-office-space-occupancy | ||

| The Use and Abuse of User Fees and Charges | Discusses the various kinds of fees and charges for municipal services, their proper use, and the methods for calculating them. | June 19, 2003 | finance municipal-operations | ||

| Benchmarking Public Education in Worcester: 2003 | This report documents the Worcester Public Schools’ performance along several measures including attendance and dropout rates, student mobility, family involvement, post-graduate placement, and MCAS scores. | June 1, 2003 | education series-benchmarking-worcester | ||

| Worcester’s Link to the Mass Pike: An Update on the Route 146 Connector | Discusses the progress of the construction of the Route 146 Connector over the past two years, as well as the project’s implications for Worcester and the surrounding region. | May 15, 2003 | transportation | ||

| Tough Choices for Tough Times: Worcester’s FY04 Budget | Discusses Worcester’s FY04 budget and proposes several options for reducing expenditures, including restructuring municipal employee health insurance and pension benefits, restructuring other public safety benefits, and reorganizing public safety departments. | March 27, 2003 | finance | ||

| CompStat and CitiStat: Should Worcester Adopt these Management Techniques? | Analysis of how the adoption of CompStat and CitiStat, two municipal management programs, in Worcester could lead to improved performance of municipal agencies and increased accountability. | February 18, 2003 | municipal-operations | ||

| Benchmarking Public Safety: 2003 | Performance measurement data related to public safety services provided by the Worcester Police Department, Worcester Fire Department, and UMass Memorial EMS (Emergency Medical Services). | February 1, 2003 | public-safety series-benchmarking-worcester | ||

| Citizen Satisfaction with Municipal Services: 2002 Survey | This presents the full data from the 2002 CCPM survey of Worcester residents regarding their satisfaction with municipal services and includes comparisons with data from previous years. | February 1, 2003 | civic-engagement municipal-operations | ||

| Questions and Comments on Worcester’s Housing Market Study | An analysis of Worcester’s Housing Market Study, particularly examining its economic relevance and feasibility to the City of Worcester. | November 18, 2002 | housing | ||

| The Case for a Regional Economic Development Alliance in the Greater Worcester Area | Recommendation for a private sector-initiated organization in the southern part of Worcester County to be called the Worcester Regional Economic Development Alliance (WREDA). | October 7, 2002 | economic-development | ||

| 2000 Census: Income and Educational Attainment in Worcester and the Region | This report compares Census 2000 income and education data for Worcester to surrounding communities and other northeastern cities. | October 1, 2002 | education | ||

| Downtown Worcester Office Occupancy: 2002 Survey | Annual analysis of downtown office occupancy rates in Worcester’s Central Business District. | September 1, 2002 | economic-development series-office-space-occupancy | ||

| Addressing the Projected Budget Shortfall in FY03 | In order to address Worcester’s FY03 anticipated budget shortfall, cost reductions and fundamental changes in the delivery of municipal services are … | April 29, 2002 | finance | ||

| A Guide to Regional Organizations in the Greater Worcester Area | Basic information on the 49 organizations that provide regional services in central Massachusetts. | March 1, 2002 | economic-development | ||

| The Worcester Regional Transit Authority: Problems and Options | This report argues that the Worcester Regional Transit Authority faces serious problems and must adopt more cost-effective methods of operation in order to avoid substantial cuts in service. | January 8, 2002 | economic-development transportation | ||

| Proposed Vocational School: Facts and Figures | Facts about the proposed new vocational school facility. | November 1, 2001 | education | ||

| Benchmarking Economic Development in Worcester: 2001 | First in a series of annual reports documenting trends in economic development in Worcester. | November 1, 2001 | economic-development series-benchmarking-worcester | ||

| The 2000 Census: A Preliminary Look at Worcester and the Region | Examines the recently released 2000 Census data for Worcester and the surrounding region. | October 5, 2001 | municipal-operations | ||

| The Use of Project Labor Agreements on Public Construction Projects: The Case For and Against | Examines use of Project Labor Agreements for public construction projects. | May 21, 2001 | economic-development | ||

| The Future of Public Housing in Worcester | The changing national landscape of public housing, in combination with recent administrative and other changes made by the Worcester Housing Authority (WHA), presents an opportunity to review public housing in Worcester and consider areas for improvement. | May 14, 2001 | housing | ||

| City Facing $5 Million Deficit in FY02: Taxes May Increase | In its yearly analysis of the City’s revenue and expenditure projections, the Research Bureau makes a number of recommendations to reduce expenditures and increase revenues. | April 24, 2001 | finance | ||

| Worcester’s Transportation Projects: An Update | An update on Worcester’s major transportation projects, including the Route 146 connector, the Worcester Regional Airport, and commuter rail service between Worcester and Boston. | January 30, 2001 | transportation | ||

| Proposals for Promoting Economic Development in Worcester | Discusses recent changes in Worcester’s approach to economic development and the opportunity they provide to strengthen both accountability and coordination between various economic development agencies. | September 27, 2000 | economic-development | ||

| Revitalizing Worcester’s Neighborhoods: Recommendations from Research Bureau Forums and Reports | In light of the deteriorating condition of many City neighborhoods and lack of a strategy to address these problems, the Research Bureau sponsored a series of forums on neighborhood revitalization in the Spring of 2000. | August 11, 2000 | economic-development | ||

| Observations on the City Manager’s FY01 Budget | Changes are needed to the FY01 budget in order to avoid higher taxes. | May 25, 2000 | finance | ||